The Go-to-Market Planning Process: A Comprehensive Guide

Key Components of Go-to-Market Planning

In today’s competitive landscape, a well-structured go-to-market (GTM) plan is essential for any organization seeking to drive B2B revenue growth profitably and at scale. A successful GTM strategy ensures that a solution reaches its target audience effectively, driving sales performance and customer satisfaction. This article will detail the key components of GTM planning, focusing on customer segmentation, customer coverage territory design and compensation.

Understanding Go-to-Market Planning

Go-to-market planning involves developing a strategy to bring a product or service to market. It includes identifying the target audience, analyzing the competitive landscape, defining product positioning and establishing sales and marketing strategies. The goal, ideally, is to ensure that the right customers receive the right messages at the right time and convert them into sales. The more realistic aim to establish a consistent cadence with potential buyers that consistently creates opportunities to win.

GTM costs (marketing, sales and service) represent a significant portion of onboard expenses for most tech solution vendors. It is necessary that leadership focuses on building a GTM configuration that not only aligns to company growth and development stage but is also fiscally responsible and scalable.

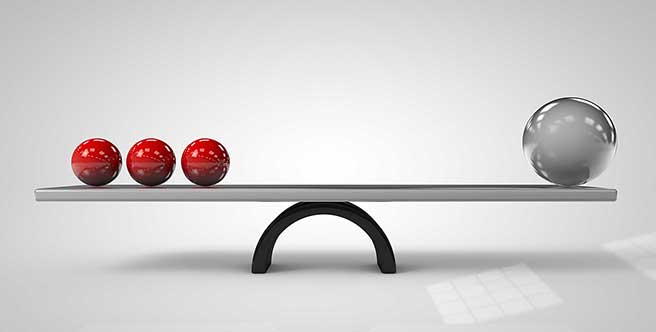

While configuring GTM componentry successfully is a linear, logical exercise, opportunities for missteps abound. The surest way to avoid errors and misalignment is to think about GTM planning sequentially and allowing upstream components to feed and inform those further downstream.

Customer Segmentation

Customer segmentation is the process of dividing a broader market into smaller, more manageable groups based on shared characteristics. This step is crucial for tailoring marketing strategies and coverage plays to specific audiences. The critical output of any customer segmentation exercise is a set of prioritized customer segments and quantified revenue potential at the account level.

Segmentation can be based on various factors, including:

- Firmographics: # of employees, # of knowledge workers, revenue size, industry vertical

- Financials: $ IT spend by category, revenue growth, profitability (EBITDA)

- Tech Usage/Proficiency: breadth of tech enablement/sophistication for customers (front-office), presence of CTO, back-office efficiency (size of IT org./employee)

- Behavioral: purchase history, consumption behavior, growth plans, market position, mergers/acquisitions

Importantly, best-in-class organizations have shifted the segmentation process and alignment from inductive to deductive. Rather than starting with the consensus of incumbent salespeople and management about what traits and characteristics constitute an ideal customer, machine learning and generative AI models allow companies to use data to guide, inform and cleanse such discussions from organizational or recency bias. The model output can then be enhanced and enriched with experiential field intelligence.

Routes-to-Market/Customer Coverage

After building customer segmentation, technology companies can effectively select their routes-to-market and customer coverage models. This step is crucial as it determines how the company will reach its target segments and engage them effectively. Below, we’ll explore how tech companies approach this selection process, along with relevant examples.

Routes-to-market refer to the strategies and channels a company uses to deliver its products or services to customers. A full route-to-market is inclusive of marketing, sales, revenue/customer management, renewal and service motions. The choice of route is influenced by factors such as customer preferences, market dynamics, the company’s operational capabilities and most importantly, cost-to-market, cost-to-sell and cost-to-serve versus overall segment yield.

It is a common misnomer that effective coverage means comprehensive coverage. In the modern B2B technology market, coverage cannot mean that the vendor must proactively cover every potential customer and prospect that could potentially buy something from them. Instead, use customer segmentation to rationalize and optimize coverage across the following dimensions:

- Coverage Need: Does a customer need sales and technical expertise to make a purchase decision?

- Vendor Importance: Does a customer require a relationship with the vendor, or can they transact and interact effectively with partners?

- Coverage Economics: Do the average selling price (ASP), customer long-term-value (LTV) potential and overall yield (sales, marketing and service Expense/Revenue ratio) justify field coverage? Inside coverage? Partner coverage? Any proactive coverage of any kind?

- Coverage Specialization: Should coverage be specialized or generalized? If specialized, across which dimensions (geographic, product, sales cycle element [e.g., land vs. adopt vs. expand], industry vertical, buying environment [global vs. local, centralized vs. decentralized]?

A definitive customer segmentation model allows organizations to effectively tailor customer coverage so that it just isn’t a one-size-fits all structure with different spans and layers for Enterprise vs. Mid-Market vs. SMB.

Territories

Once technology companies have established a route-to-market strategy, the next crucial step is to build an effective territory structure. A well-defined territory structure helps ensure that sales teams can effectively reach their target customers, maximize coverage, optimize resources and have a realistic chance to meet and exceed sales targets (quotas). Here’s a look at how tech companies can build an effective territory structure, including key considerations and examples.

- Define Territory Goals: Does the organization want to equalize territory potential across quota-bearing heads, or does it want to concentrate more potential among top-performers?

- Prioritize Territory Dimensions: Is it more important to minimize windshield time or concentrate vertical focus? How should territories be configured in hybrid assignments (prospect versus existing customers)?

- Determine Acceptable Disruption: What is the level of organizational tolerance for breaking existing customer relationships?

- Set Territory Integrity Constraints: What causes an account to move up or down in the segmentation structure; how often should this be done? What is the policy on moving existing accounts from open territories to inhabited ones? How much over-assignment should exist in the system between the C-level and individual contributor objectives?

Again, the benefit of engaging in a linear GTM planning process is that it eliminates some of the anecdotal guesswork that can be potentially complicating or distracting. Establishing customer segmentation based on account-level potential and building routes-to-market removes a significant amount of ambiguity from territory building and allows a much clearer link between territory configuration and overall GTM strategy.

Sales Compensation

Aligning marketing, sales and service compensation plans with GTM strategy is a crucial step for B2B tech companies to drive sales performance and ensure that their teams are motivated to achieve business objectives. Once customer segmentation, sales coverage and territory plans are established, companies can design compensation plans that incentivize behaviors that align with their overall GTM strategy. Below, we outline how B2B tech companies can achieve this alignment effectively.

Before designing sales compensation plans, it’s essential to have a clear understanding of the business objectives that the GTM strategy aims to achieve. These objectives may include:

- Revenue Growth: Increasing sales volume across specific customer segments.

- Market Penetration: Expanding into new territories or industries.

- Customer Adoption and Retention: Enhancing customer satisfaction and loyalty; ensuring the solution as sold is delivering on results promised during the sales cycle.

- Cross-Selling and Upselling: Encouraging sales teams to sell additional products to existing customers.

- Consumption: Driving the customer to utilize a given solution at higher volumes (e.g., additional workflows in a process-automation solution, additional terabytes of consumption in a virtual storage solution, additional compute capacity in an AI solution).

Determining target customer segments (with account-based potential), coverage models by segment, territories and business objectives provides the foundation to select the right compensation structures individually by GTM role.

There are many excellent articles on Alexander Group’s website that explore the intricacies of how to configure critical compensation elements such as pay mix, measures, mechanics, hurdles, gates, thresholds, pay and performance periods, special incentives (SPIFFs); but these are merely tactical decisions based on preference and affordability. The linchpin of effective compensation planning is to ensure the tie between the sales compensation program structure and the overall GTM plan.

Conclusion

Crafting a comprehensive go-to-market planning process is vital for B2B tech companies aiming to thrive in today’s competitive environment. A well-structured GTM strategy, encompassing customer segmentation, routes-to-market, customer coverage, territory design and compensation alignment, lays the foundation for driving revenue growth and enhancing customer satisfaction.

By meticulously defining customer segments, tech vendors can tailor their marketing efforts and sales strategies to meet the unique needs of each group. This targeted approach not only optimizes resource allocation but also ensures more effective engagement with potential clients. Furthermore, aligning routes-to-market and customer coverage with these segments allows companies to strategically deploy their sales forces, maximizing their reach and impact.

An effective territory structure ensures that sales teams are positioned to meet their quotas and serve customers efficiently, while thoughtful compensation plans motivate sales representatives to achieve business objectives. By linking sales compensation directly to the GTM strategy, organizations can drive behaviors that foster revenue growth, customer retention and cross-selling opportunities.

Ultimately, the go-to-market planning process is not a one-time exercise but an ongoing strategy that requires regular evaluation and adaptation. As market dynamics evolve and customer needs shift, B2B tech vendors must remain agile, continuously refining their GTM approach to seize new opportunities and maintain a competitive edge. By embracing a data-driven mindset and leveraging insights at every stage of the planning process, tech companies can position themselves for sustained success and long-term growth.

Need Help?

For more information about how Alexander Group can help in your go-to-market planning process, contact a Technology practice lead today.