Top 10 Strategies to Influence Profitable Growth

Profitability is back – sales efficiency and sales productivity are top of mind for revenue leaders.

It’s 2023 and inflationary pressures and other macroeconomic factors have increased the cost of capital and had a slowing effect on tech spending across the economy. As such, the technology industry has gone from aggressive hiring and sales investment to a more careful approach to spending, so much so as, in many cases, leading to layoffs. With a stronger focus on the bottom line and more constrained growth, companies have their eye on profitable growth. To do this effectively, leading technology companies are revisiting the foundational building blocks of the commercial organization and go-to-market (GTM) model.

With the future unpredictable, CROs should consider a handful of key initiatives to drive profitable growth. Specifically, these initiatives span many foundational GTM building blocks including segmentation, coverage and compensation.

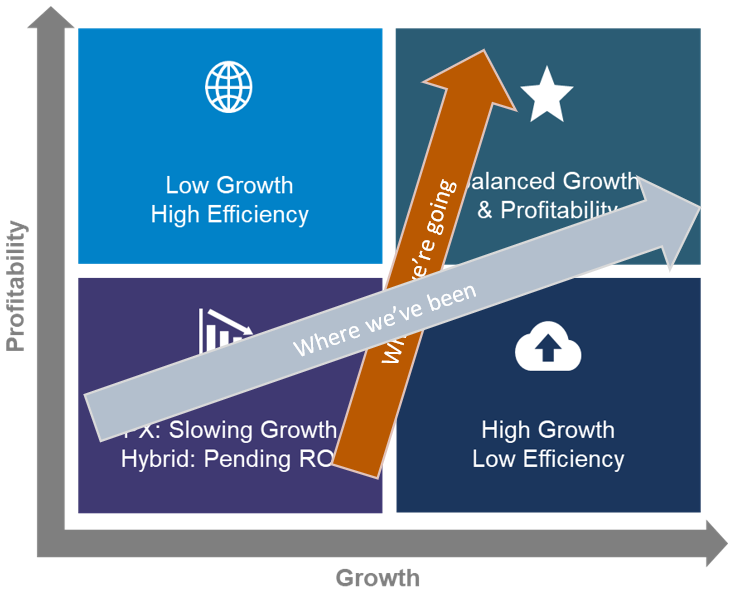

How We Got Here & Where We Need to Go

Up through 2022, the technology industry, and especially SaaS companies, were all about growth. To maximize recurring revenue, organizations invested in resources across marketing, sales and customer experience, all with the intent of driving as much growth as possible. These investments manifested themselves in terms of both high touch and broad programs, all of which were meant to drive incremental growth, but not necessarily with a strong focus on profitability. Some of these initiatives included:

- Investments made in brand and demand generation motions and tools

- Separate segment and functionally aligned commercial teams

- Geographically dispersed resources

- Broad channel incentive programs

- Increase in management, technical and/or customer experience overlays

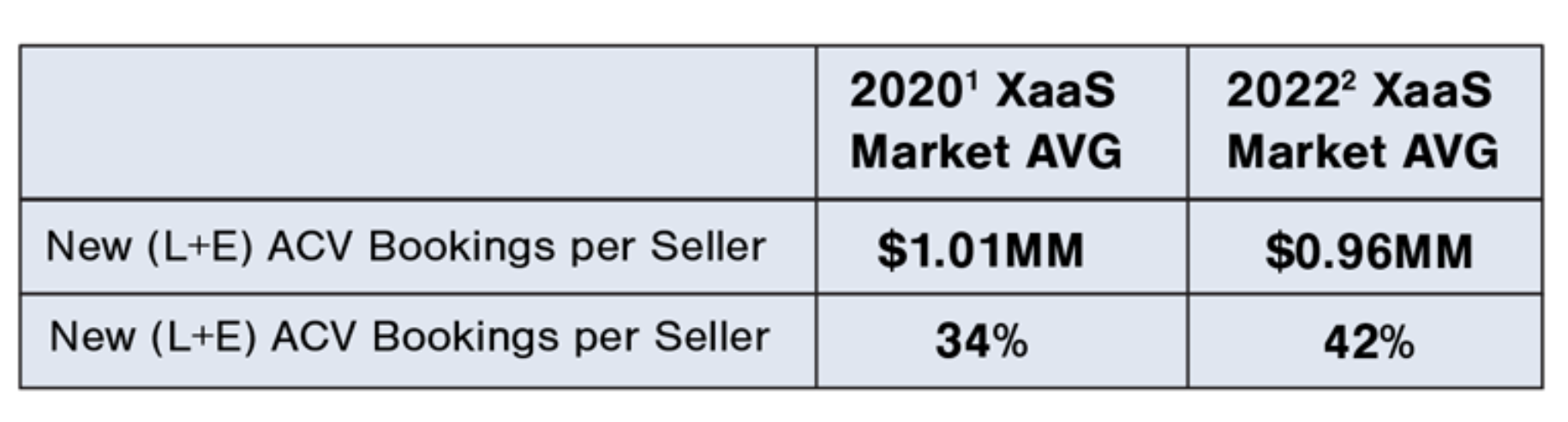

However, coupled with recent macro environmental factors, the end result for most companies was a high cost GTM model with stagnated growth. The table below from Alexander Group’s 2022 XaaS Research and Benchmarking showcases this stagnation.

With an increasing focus on profitability and optimizing to the Rule of 40, leaders are adjusting their commercial organizations – and it’s more than just cost cutting measures. Today’s revenue leaders need to take a surgical approach to understanding where the path to most profitable growth is and then tailoring the commercial organization to align to that path.

Where We Are Headed

The adage, “learn how to do more with less” has become the technology industry’s new mantra. Given this reality, Alexander Group has provided a top ten list of GTM options that CROs, CCOs and other C-Suite stakeholders in charge of profitable revenue growth should consider.

- Dissect the TAM and prioritize allocating resources to where you have the ‘right to win’

- Increase the focus on understanding the Ideal Customer Profile (ICP) and derive a specific set of use cases and value propositions targeted to the ICP needs

- Increase investment in field marketing vs. brand marketing

- Hone your company’s “Sell-With” motions between partners and your own sales teams

- Double down and focus on partners that have proven a specific value to your customers

- Examine your core selling team and align higher cost resources to high opportunities, identify segments or customers where coverage can rely on self-serve and/or lower cost internal sales resources

- Invest in sales support resources that enable core sellers to improve sales productivity

- Stretch the manager, overlay, and technical specialist coverage ratios

- Revisit compensation plan measures and mechanics to ensure pay is aligned with profitable growth

- Normalize attainment distribution through better alignment of territories, quotas and sales talent

Strategy & Segmentation

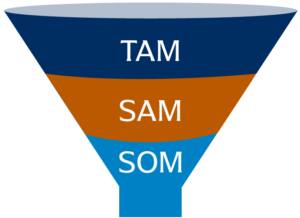

Companies focused on profitable growth are 1) understanding and prioritizing where there is large total addressable market (TAM) and where they have the ‘right to win’, 2) doubling down on their Ideal Customer Profile (ICP) efforts to better understand their service addressable market (SAM) and service obtainable market (SOM) and 3) increasing investment in field marketing relative to brand marketing.

Companies focused on profitable growth are 1) understanding and prioritizing where there is large total addressable market (TAM) and where they have the ‘right to win’, 2) doubling down on their Ideal Customer Profile (ICP) efforts to better understand their service addressable market (SAM) and service obtainable market (SOM) and 3) increasing investment in field marketing relative to brand marketing.

However, just knowing the TAM is not good enough when it comes to aligning a commercial organization’s focus. Think of TAM, SAM, and SOM as three different stages in a funnel: TAM feeds into SAM (i.e., what customers both fit with the company’s products and services and are reachable), and SAM feeds into SOM service (the subset of customers from SAM where the company has a “right to win” and the best chance of securing those customers).

To maximize profitable growth, marketing and sales organizations need to focus their investments on the most likely customer and prospects, the SOM. To maximize SOM, commercial organizations need to understand the ICP at the account level. This is where an organization has a ‘right to win’ with a targeted use case. Understanding buyer profiles within these ICPs will ensure that organizations are delivering targeted messages and use case applications where they will resonate.

In an effort to reach these prospective buyers, organizations are investing in field marketing activities rather than spending on brand. “Profitable growers”, a cohort of companies experiencing above average growth and margins, invest 41% more than their peers in marketing demand stimulation, resulting in a 34% faster customer acquisition cost (CAC) payback period3. These organizations craft and deliver targeted messages on a segment specific level where the use cases will resonate the most with the ICP, similar to account-based marketing.

Coverage

Channel

Optimizing the use of channel partners is an area where many companies fall short. Partners are most often a key component of a XaaS vendor’s ability to provide both reach and more complete solutions to end customers. That said, not all salespeople understand how to work with their partner counterparts in a productive manner. This inefficiency leads to higher costs and often has detrimental effects to both customer and partner relationships. Companies focused on driving profitable growth are almost universally more adept at leveraging partners, and this shows up at the ground level with carefully honed engagement models between direct and partner sales teams.

Organizations should cultivate their partner ecosystem to ensure that the partners are providing added value to the customer in terms of sales, service or build services. The first step is evaluating the partners to understand which ones are providing the most value to the organization whether it be in the form of geographic reach or services. Once those ‘high value’ partners are identified, the organization should explore ways to strengthen that partnership through increased focus, investment and enablement to continue to cultivate the symbiotic relationship. Additionally, during the partner evaluation exercise, organizations should also investigate where there are gaps in the ecosystem with either lack of geographic reach or service capabilities. While partner recruitment, on-boarding and initial enablement is not necessarily a ‘quick-win’, understanding and planning to close the gaps is an essential step in fostering a robust partner ecosystem.

Core Seller Productivity

With the increased focus on productivity, revenue leaders should ensure that their core selling resources are focused on both high value accounts and high value sales activities. Core sellers should focus on engaging with and developing high value accounts while passing simpler, less complex deals to a different pool of lower cost resources – such as inside sales or even self-service. Defining and understanding which accounts are deemed high value based on variables such as potential opportunity, current spend or buying centers will allow reps to aim focus on their highest value accounts.

Additionally, core sellers should focus on executing high value sales activities such as prospecting, account development and persuasion activities rather than customer service issues or administrative tasks. Revenue leaders can conduct a point-in-time survey, interviews or focus groups to understand a ‘day in the life’ of the core seller to understand how they are spending their time as well as what roadblocks are taking attention away from high value sales activities. Removing roadblocks via adding additional processes or sales support resources will allow core sellers to increase productivity by being able to offload low value sales activities.

Overlays Productivity

Overlays (product specialists, sales engineers, customer success managers, management), by nature, are deployed within an organization to increase seller productivity by bringing specialist knowledge to the system or to provide better coaching and training for sales managers. To ensure organizations are capturing appropriate ROI on the overlay roles, it is important to understand the core activities and expertise that these overlays need to provide during the sales process to drive role clarity and clear rules of engagement.

There is always slack in the system, resulting in overlay roles executing activities that are not part of their core purpose. Identifying the “slack” presents a great opportunity to become prescriptive with role responsibilities and most importantly, re-evaluate and clarify role responsibilities to ensure they are appropriate to their level and cost to the organization. Understanding utilization of the specialist resources will help uncover what activities they should stop doing as well as clarify which steps of the process they should own. Reinforcement of the new rules of engagement and role expectation by sales management will ensure adherence to the new engagement model. If an organization can be increasingly deliberate about expectations for each role, there is an opportunity to tighten the coverage ratios without compromising the customer experience.

Sales Compensation

Sales compensation is most often the largest expense that goes into the selling, general and administrative expenses (SG&A), and revenue leaders should regularly revisit the compensation program to ensure they are receiving the most ROI out of the program.

When it comes to compensation plan structures, leaders should review both plan measures and mechanics to ensure they align with role responsibilities, business objectives as well as profitable growth initiatives. Conducting a holistic compensation assessment to understand potential gaps will allow leaders to make tactical changes to the compensation plan measures to tightly align sellers to driving profitable growth. Additionally, crafting pay curves that reward above goal performance will ensure that high earners are being rewarded for results to help drive profitable growth.

Finally, while assessing the current state, organizations should look to understand the performance attainment distribution. Bimodal results can be expensive. A handful of top performers may be paid accelerators for exceeding their goals while the organization misses the larger overall target because a large number of sellers fell below their goals. In these instances, organizations should look to rebalance territories and review the quota setting and allocation process. Fully understanding the value of your organization’s sales compensation spend will help you set achievable goals that align to the potential opportunity in the territory and drive stretch. Coupling changes in plan structures with adjustments to the quota methodology and allocation process will improve outcomes without sacrificing growth or efficiency.

Conclusion

With profitable growth top of mind, revenue leaders have many levers they can explore and use to make adjustments to their commercial model. That said, the top 10 initiatives listed above are all about going back to fundamentals and making strategic changes in core areas such as segmentation, coverage and compensation.

1. 2020 XaaS Research: Revenue Models and Productivity 2. 2022 XaaS Research: Revenue Models and Productivity 3. Research Briefing: Commercial Practices to Drive Profitable Growth & Valuation

Alexander Group Can Help

Are you interested in hearing more about strategies to drive profitable growth?