What Tech Leaders Must Do In the Second-Half of 2020

More than 60 revenue and revenue operations technology leaders across the world came together at a recent Alexander Group virtual roundtable to share their experiences and expertise.

This robust discussion focused on four key areas for second-half planning and actions:

- Account Targeting: As certain geographies and market sectors are experiencing different conditions due to COVID-19, it is proving critical to reassess segmentation and identify high potential accounts. In order to capitalize on short-term growth, organizations should conduct rigorous account targeting to identify accounts that have spend capability in the second-half of the year.

- Territory Balancing: 40%1 of tech companies have reduced or plan to reduce headcount. With the new scope of commercial resources, and as accounts are re-prioritized, organizations need to rebalance territories to match sales capacity with opportunity (e.g., move resources from Oil & Gas or Hospitality to Tech)

- Quota Adjustment: 20%1 of tech companies have provided quota relief with another 47% considering it. As revenue leaders take action, it is imperative that quota adjustments correspond with headcount alterations, align to territory changes and provide sellers with realistic performance expectations.

- Incentive Compensation Update: 40%1 of tech companies are considering sales compensation plan changes. In making these changes, focus on retaining “A” players and top customers. Balance flexibility with consistency when designing second-half plans.

1 2020 Alexander Group COVID-19 Flash Survey

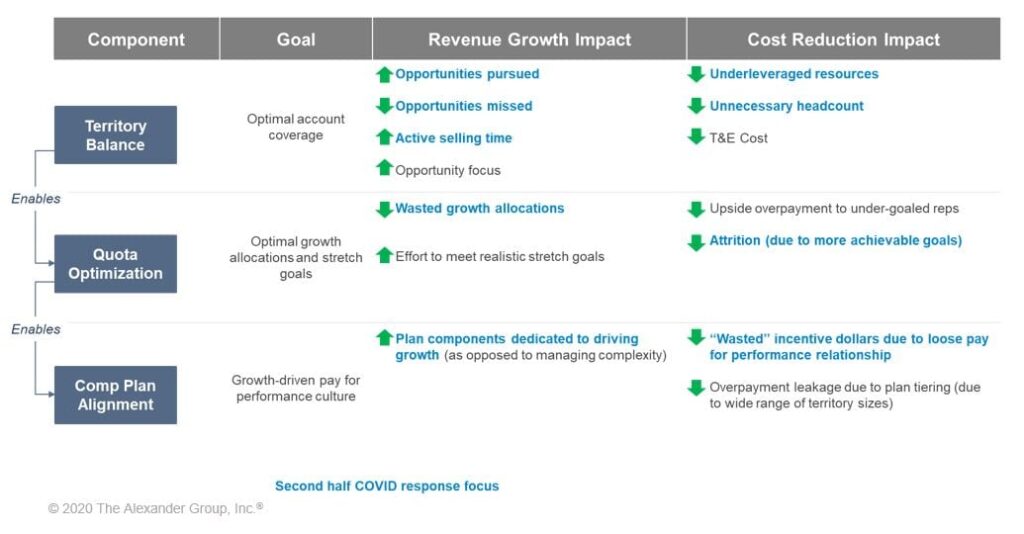

Roundtable topics are closely linked as the following illustration shows. Territory rebalancing, whether due to headcount adjustments, account re-prioritization or both, creates downstream opportunities for quota optimization and sales compensation plan alignment.

Touching on each of the areas, roundtable participants shared a variety of perspectives on key changes, both short-term and more permanent, to position their organizations for growth.

Leverage Data To Make Decisions

To drive strategy and inform targeting and rebalancing, revenue leaders are using data and insights in different ways.

- Utilize market data to re-index accounts & update forecast: One of the participating companies is leveraging Moody’s risk assessment tools to index accounts (e.g., which industries are most and least distressed). Output from the indexing exercise is being used to rationalize short-term opportunities, adjust territories and recalibrate pipeline to drive a more reliable forecast.

- Leverage country trends to predict outcomes: While point-in-time data points are important, trend analysis further enriches the data set needed to take decisive action during these disruptive times. Citing hotels at 50% capacity in China (but much lower in other countries), a global sales leader is studying the re-open trajectory at a country level to inform short-term investment and resource allocation decisions. Additionally, this research is expected to yield an estimated re-open timeline for other countries that have yet to emerge.

- Capture voice of customer to reallocate resources: Some organizations are directly utilizing customer feedback to make decisions. One SVP described a three-step process:

- Step 1: Maintain patience while customers work to understand their roadmap

- Step 2: Validate all projects and their scope, ignoring any pre-COVID-19 assumptions

- Step 3: Reallocate support resources from applications negatively impacted to those positively impacted

- Survey customers to inform sales pursuits: Building on the voice of customer theme, a software sales leader surveyed several hundred customers to understand when they expected to “get back to work” and revisit budget and vendor proposals. The organization extrapolated this data to rate customers on a 1 – 3 scale, and make territory and quota adjustments accordingly. In some cases, leadership is making more permanent coverage model changes (e.g., pivoting to distribution model). Sellers are also utilizing these account scores to prioritize sales pursuits.

Measured and Targeted Short-Term and More Permanent GTM Changes

As leaders are converting data and insights into action, many are taking measured and targeted approaches in their sales deployments and management programs.

- Make marginal shifts to mitigate the risk from over-rotating: One sales organization is making minimal changes through a “wait-and-see” approach. Noting the Oil & Gas sector with long sales cycles and quickly changing prospects, there is a bigger risk of over-rotating and back peddling relative to doing nothing.

- Focus changes on inside sales: One sales leader is focusing deployment changes entirely within inside sales. Because of the geographic flexibility and more transactional sales approach, inside sales can more nimbly respond to re-training and re-focusing than field sales.

- Leverage inside sales across a greater portion of the segmentation model: A global software leader expanded on the topic of inside sales. His organization is amplifying inside sales for more permanent changes based on the success they’re seeing in remote customer engagement. Based on this initial success, leadership is making a calculated bet by increasing the segmentation line (from SMB to lower middle-market) that inside sales covers.

- Apply virtual engagement on a more permanent basis: One Americas sales leader is looking to increase virtual support among the organization’s 1000+ specialists. This includes optimizing virtual proof-of-concepts executed by the organization’s engineers and architects. Shifting more resources from field to virtual deployment is expected to yield greater sales efficiency and profitability.

- Re-train even the most seasoned reps for new activities: Even with minimal organizational changes, one leader highlighted the continual training needs required to succeed in a remote selling environment. For example, to access new customers and buyers, many tenured sales reps need to re-learn outbound prospecting in a modern environment (leveraging digital tools, supporting campaigns, targeting appropriate buyers with the right content and IP, etc.).

- Shorten performance periods: Finally, multiple participants cited migration from annual to semi-annual sales compensation plans allowing for more quota flexibility. One global sales operations leader noted his organization can now more quickly course correct to keep sellers engaged and “in the game.”

The current tech selling environment is facing rapid change but forward-thinking revenue leaders are taken bold actions to drive growth in the second-half and beyond. We heard from many revenue leaders who are taking action to mitigate churn, pivot towards opportunity areas and invigorate sales force morale. The Alexander Group recognizes the challenges facing businesses in these uncertain times, and will continue to share perspectives to ensure our community stays abreast of contemporary trends.

Additional XaaS Assets for Your Company

Learn more about upcoming events for tech leaders.

Navigate to our tech industry practice page for contemporary insights on revenue growth.

Participate in in our complimentary 2020 XaaS Strategy Research to capture the latest tech trends, benchmarks and insights.

Chris Semain, principal in the San Francisco office, contributed to this article.