Selling a Connected Widget

Software Solution Selling in the Traditional Hardware Product Space

It is an exciting time for many traditional manufacturing companies. The digitization of their businesses through the internet of things (IoT) presents a significant opportunity for reinvention through big data. But success in this environment requires a willingness to reevaluate what’s worked in the past and embrace the challenges of a digitized world–realigned business models, new job roles, enhanced skillsets and sales compensation considerations.

Opportunities to capitalize on the new technology are in abundance across the manufacturing space:

- Industry 4.0 for industrial manufacturers to enable centralized asset monitoring or predictive maintenance and analytics

- Building material manufacturers with new building automation capabilities

- Agricultural applications to collect environmental conditions in a cloud-based architecture

Expanded offerings gives manufacturers new opportunities to present enterprise software with their manufactured products. Organizations are clamoring to capture these new and attractive revenue streams to better entrench themselves at key customers, increase their profitability, maintain their competitiveness in the market, and/or establish a predictable revenue stream. As organizations race to capture first-mover advantage, many are finding challenges to their business model: what worked for years, decades even, does not necessarily apply to monetizing data and insights through this enterprise software. As a result, organizations must reassess their go-to-customer strategy, structure and ultimately their management levers to achieve these objectives. This article explores the go-to-customer strategy reassessment: namely the need to realign revenue motions and value propositions to support new buyers with different buying processes.

New Buyers & Buying Processes

Primary decision-makers for enterprise software solutions are no longer the traditional buyers of yesterday that sellers targeted. First, integrating traditional hardware into the enterprise software infrastructure often requires purchasing authority from someone in the IT organization. This puts the buyer not only in a new functional area, but also it often requires executive level signoff due to the responsibilities involved in managing system-wide data and the integration with other enterprise-level systems.

As an example, a traditional factory automation buyer may be a controls engineer. This controls engineer likely has limited influence over the (MES) used to monitor and provide predictive analytics for their machinery on the factory floor. This purchasing decision typically filters high up in the IT organization, sometimes even the CIO. This is not only due to the capital investment required, but also due to the invasive nature of integrating to the company’s infrastructure.

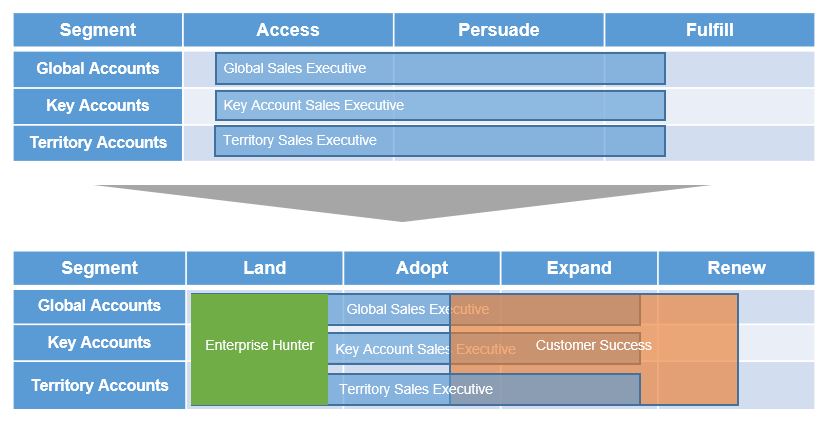

The more multifaceted buying process results in more complex, and often longer, revenue motions where the seller requires additional competencies to navigate this “enterprise” sale. To further add to the complexity, in the case of a subscription consumption model, these revenue motions begin at the point of the initial sale and require a deliberate nurturing process. These subscription-based revenue motions follow the land, adopt, expand, renew model.

- Land – This is the initial sale of the software solution.

- Adopt – After the initial sale, the software must become an integral part of the process and an invaluable part of optimizing the customer’s experience. Optimizing the post-sales customer experience requires all possible users adopt the solution.

- Expand – Continued ongoing success can often lead to revenue expansion through upselling enhanced offerings and capabilities or expanding usage through additional subscription seats.

- Renew – With an effective adoption/expansion implementation, the contract renewal process should not only be a formality, but should also further drive cross-sell and upsell opportunities. This is critical in a subscription-based revenue model to maintain the revenue stream.

Revenue motions often require handoffs with clear and deliberate rules of engagement to ensure the sales process is optimized to the customer experience.

New Value Propositions

Sellers will have to adapt to the new buyers’ preferences by identifying and communicating relevant value propositions. Frequently the enterprise software solution enhances the deployment and usage of the hardware product, and by nature touches on potentially critical and impactful value drivers. Sellers should nuance these value propositions to align to all new buyer stakeholders. Specifically, sellers must effectively communicate these differentiated advantages at the right time with the right objective evidence—all of which requires time and effort through an understanding of the software functionality and benefits.

Besides recognizing the various buying processes and revenue needs of their customers, manufacturers should also consider the following to effectively monetize revenue opportunities through the digitization of hardware manufacturing: new job roles required to support sales execution; different skills and competencies, metrics to measure performance and considerations for the quota-setting process; and sales compensation program considerations to attract talent and motivate software growth.

Digitization of Manufacturing Drives New Sales Roles for Changing Buyers

As manufacturers begin to understand the buyer journey and align it with the sales process, they will need to ensure they have the right roles to execute on all aspects of the sales process. The buyer is changing as we shift to more technical sales; likewise, sales roles are shifting to accommodate that change.

The traditional manufacturing sales model predominantly relied on the core seller to execute the majority of the sales process with the help of pre-sales and overlay resources to support the sale.

As mentioned above, the phases of sales process will shift from the typical access/persuade/fulfill to land, adopt, expand and renew. Effectively supporting these new sales stages requires the deployment of specialized sales resources. Two key roles that are critical to the success of this new overage approach due to a changing buyer and a subscription-based revenue stream are: enterprise hunter and customer success manager.

Enterprise Hunter

Enterprise Hunter

As the customer shifts from a traditional buyer to likely multiple buyers in the information technology field managing the enterprise infrastructure, there is a need to create new relationships. The enterprise hunter role’s sole remit is to uncover opportunities and liaise with the technology buyer. The enterprise hunter will have a skill set more closely aligned with traditional tech roles as opposed to manufacturing roles. They will have to articulate different value propositions that resonate with the IT buyer focusing on the ROI of the solution. In order to be successful in penetrating this buyer, manufacturers will have to leverage sellers from technology.

Customer Success Manager

The subscription-based revenue stream associated with a connected widget requires a significant adoption and post-sale engagement process. After the buyer acquires and implements the solution, the manufacturer needs to ensure that the solution is adopted. This is a critical step to ensure that customer continues to pay for the subscription license which provides the manufacturer with the ongoing revenue stream. To support this, most companies leverage a dedicated sales role: the customer success manager (CSM).

Support-Focused: The CSM function is responsible for providing support to existing customers to ensure they have a positive customer experience.

Adoption-/Usage-Focused: The CSM drives adoption and usage of the technology across the customer.

Upsell-/Retention-Focused: The CSM is responsible for retaining the revenue by renewing contracts. They also have some responsibility for driving additional revenue by uncovering and closing upsell opportunities.

Expansion-Focused: The CSM is responsible for identifying opportunities in exciting accounts and driving sales by providing additional solutions for the customer.

The customer success function is a key piece to ensuring the manufacturer continues to drive subscription revenue.

After understanding the new necessary job roles, manufacturers will also have to consider what ‘types’ of individuals will be successful in executing these new revenue motions. Manufacturers will need to ensure that once they have the right roles and talent, they have the right enablement tools to ensure they can measure, motivate and retain talent.

Aligning Competencies and Metrics

To effectively identify and deploy resources of those two distinctly different roles from the traditional manufacturing space – enterprise hunters(responsible for landing new logos) and customer success managers (responsible for ensuring adoption and expansion) – manufacturers should strongly consider what makes these roles unique and successful.

Enterprise Hunter Competencies and Metrics

The skill set needed for enterprise hunter aligns more closely with those found in tech organizations than in manufacturing companies. To navigate the longer and more complex buying process, sellers must have strong business acumen to communicate the longer-term ROI of a solution. This is particularly important when working with a broad set of executive stakeholders.

Often times, manufacturing organizations will find their traditional sellers exhibit varying degrees of technical competency. In these scenarios, it may not necessarily be a requirement for success. For the software enterprise hunter, however, strong technical acumen is a necessity. Specifically, the enterprise hunter typically requires an understanding of the enterprise architecture: how the product integrates, communicates with other systems and adheres to security protocols.

Metrics to measure the performance of these sellers are different from the traditional account manager. Because of the aforementioned longer sales cycle, forward-looking diagnostic metrics become more important. Pipeline progression and milestones such as completed demos and executed trials can serve as leading indicators to gauge if the seller is tracking with the level of performance the organization expects.

Customer Success Manager Competencies and Metrics

If the software service is a subscription-based model, another common role is the customer success manager. While there are different valences to this role, ultimately CSMs are chartered with ensuring that customers are effectively and appropriately leveraging the technology. The overarching theme is strong account management capabilities. It is critical that candidates have strong relationship skills and problem-solving capabilities, involving sales representatives only as needed. Additionally, CSMs need to serve as advocates by ensuring the customer adopts and uses the solution and is thereby realizing ROI. To that end, the CSM must understand and communicate the impact and value of the solution.

With very specific charter, metrics become intuitive. Penetrating accounts through adoption and expansion, a strong proxy for success would be usage metrics such monthly recurring revenue churn, expansion monthly recurring revenue. More specific metrics might be the usage of specific functionality if it serves as a proxy for strategic growth objectives or drives the stickiness of the product. Ultimately, a strong indicator of CSM performance is the customer satisfaction: net promotor score (NPS). This is particularly important for CSMs with limited focus on expansion responsibilities.

Establishing the appropriate competencies and metrics is fundamental to focus sellers.

Performance Management

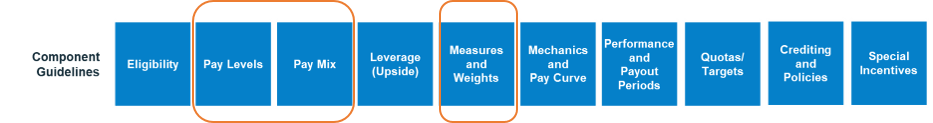

Sales compensation is an alignment tool. As such, it is important to ensure that the associated sales compensation roles support the behaviors the roles are required to execute in the field. For enterprise hunters and CSMs, consider these three main components:

Pay Levels–The Total Target Compensation for the job. This is the sum of base salary and the incentive pay at target.

Pay Mix–The split of base salary and incentive as a percentage of Total Target Compensation. If a job’s total target compensation is $100,000 and it has a 60/40 pay mix. The base salary is $60,000 and the target incentive is $40,000.

Measures–Metrics against which incentive pay is awarded (e.g., revenue, profitability, key sales objectives)

Enterprise Hunter Compensation Components

Pay Levels:

Pay levels for the enterprise hunter tend to be higher than typically seen in manufacturing organizations. These pay levels usually mirror pay levels for high technology sellers.

Pay Mix:

Pay mix for these enterprise hunter roles tend to have more pay at risk than traditional sellers in the manufacturing space. These roles will have a pay mix of 50/50—60/40 as compared to the traditional manufacturing seller which has a pay mix closer to 70/30-80/20.

Measures:

Common measures for the enterprise hunters include bookings. However, organizations may also be interested in landing new logos. While the overall bookings value is important, they might opt to pay the enterprise hunter for landing the initial booking regardless of deal value. Additionally, to ensure that the enterprise hunter has the ability to capitalize on an initial expansion, some organizations have structured crediting rules so that the Enterprise Hunter will earn incentive on all bookings in the account for a certain period of time during the expansion.

Customer Success Manager Compensation Components

Pay Levels:

Customer success managers have been gaining traction in organizations with recurring revenue models. These roles are critical to ensuring that the customer adopts the technology. They also continue to drive usage throughout the life of the contract. If the customer success manager does their job well, then the organization should be able to capitalize on renewals and upsell and cross-sell opportunities.

Since the CSM role is just gaining traction in the industry, AGI suggests that organizations conduct pay level benchmarking to ensure that the pay level for the CSM role aligns with industry standards.

Pay Mix:

There are multiple ways to deploy the CSM. Some carry a low amount of pay-at-risk to provide a linkage to sales results without risking service focus. Pay at risk can range from 80/20-90/10. If the role is deployed to drive usage of the solution, the role can be 100% base salary and have no pay at risk.

Measures:

Customer success managers’ sales compensation measures can potentially include:

- Upsell in assigned accounts

- Cross-sell in assigned accounts

- Renewals

- Number of customers that maintain usage

- Customer satisfaction

Depending on which measures are included in the compensation plan, the organization should ensure that they are able to accurately measure these data points.

Embracing the challenges of a digitalized world requires continual reevaluation across the firm not only to optimize the customer experience but also to capitalize on the abundant opportunities available.

Are you ready to reevaluate your sales compensation plan’s roles and components? Contact an Alexander Group manufacturing leader.