A Guidebook for Global Sales Compensation Pay Mix

What Is Pay Mix?

Pay mix is a ratio between an employee’s base salary and variable pay. Pay mix is a key element of any sales compensation program and budgeting process. Variable pay is used to help motivate sales people and align them to the priorities of the business. Companies also recognize that sales reps perform other tasks that take time away from selling and that 100% variable pay plans are often not competitive in the market.

The base salary accounts for non-selling administrative and office tasks or other activities that may contribute to the overall relationship with a buyer but aren’t directly related to the closing of a specific opportunity. No matter the person’s sales results, they will earn this fixed rate. The amount of base salary may be higher as a percentage of total pay for a variety of reasons including the length of the sales cycle and the requirement to engage in activities not directly associated with closing a sale. For example, global account managers that are responsible for a range of customer activities typically have a higher base salary as a percent of their total compensation compared to a new business sales person focused on mid-market accounts selling products with a short sales cycle.

The variable pay in a pay mix is based on the performance of the individual or team. The amount earned varies each year (or quarter or month) based on their results. Companies use a variety of approaches and techniques to calculate variable pay based on the role of the job, market practices, and business priorities

Benefits of a Targeted Pay Mix Strategy

Pay mix motivates sales representatives by basing part of their pay on their results. The proper ratio keeps each individual motivated to perform well in their role. It also communicates the importance of engaging in other non-selling activities that are part of the role, acknowledges the cadence of the sales process and avoids the high stress of relying only on variable pay.

Successful businesses plan the pay mix to match their unique sales situation. Their ratios are often targeted to be competitive with other companies in their industry and geography. The right mix maximizes sales potential while improving retention with satisfied employees.

How to Manage Sales Compensation In Different Countries

Does the pay mix vary by country, allowing local leaders to determine the pay mix for their sales job within their assigned country? Or, is the pay mix globally consistent regardless of job location? What are the advantages or disadvantages of varying the pay mix versus making them globally consistent? More importantly, what is the best-in-class methodology for setting and managing pay mixes globally?

Pay Mix Primer

Before examining global versus local practices, here is a quick primer on the sales compensation pay mix. This information also explores why sales compensation programs generally use a pay mix methodology rather than a percent of base salary approach most often used in management and gainsharing incentive plans.

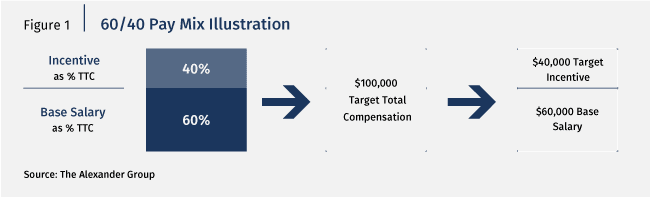

Pay mix is the ratio of base salary to the target total compensation (TTC) and target incentive to the TTC. In other words, 60/40 means 60% of TTC is the base salary, and 40% of TTC is the target incentive. For example, if a job has a TTC of $100,000 with a 60/40 pay mix, the base salary would be $60,000 (60% x $100,000). The target incentive would be $40,000 (40% x $100,000). (See Figure 1.)

Sales compensation pays for persuasion, which is convincing the customer to buy something from the company. The market generally uses a pay mix methodology (as opposed to a percent of base salary approach found in management programs) to reinforce the at-risk status of the target incentive until goal achievement. In other words, sales representatives can only achieve their TTC once they hit their goal (usually in the form of a sales quota).

For example, this is a typical communication to sales representatives: “Congratulations on your new sales job. We are committed to paying you our market-competitive target total compensation package of $100,000. Your base salary is $60,000 and will be paid biweekly. Your incentive compensation will vary based on your performance against your sales quota and be paid monthly.

If you achieve your target sales quota, you will earn your full $40,000 target incentive. If you miss your target sales quota, you will earn less than your target incentive, consistent with your performance. If you exceed your target sales quota, you are eligible to receive accelerated payouts to reward you for your over-quota achievement.”

Management and gainsharing incentive programs provide a base salary with a bonus opportunity. The bonus is expressed as a percentage of the base salary. For example, a management incentive program may pay a leader a $100,000 base salary with a 25% base salary bonus opportunity. The bonus opportunity is equivalent to $25,000 ($100,000 x 25%). Sales compensation programs generally do not use this methodology because it does not explicitly communicate the at-risk nature of the incentive.

Pay Mix Management Practices

Companies will vary pay mixes for each job based on the job’s level of persuasion. For example, a direct sales representative position responsible for prospecting, qualifying and closing deals may have a 60/40 pay mix. An overlay technical specialist providing technical expertise during sales may have an 80/20 pay mix.

Similarly, most companies vary pay mix for the same job across countries. Results of the Sales Compensation Trends Survey demonstrated 64% of the global sales organization participants vary in pay mix by country. Among participants, 36% use globally consistent pay mixes.

Global pay mix principles and rationale vary from company to company. Companies that allow pay mix to vary by country generally have the following principle: “Pay mix changes based on the role’s degree of persuasion/influence in the sales process. It aligns to local market benchmarks to recruit and retain top talent.”

These companies typically cite one or all of the following reasons to support their practice. First, they may wish to accommodate local market practices regarding at-risk pay tolerance to ensure they can recruit and retain the right talent for that marketplace. Second, the job content and degree of persuasion may vary based on selling requirements in the local market. And third, the company might allow pay mix variance to match the local performance management narrative.

Companies that use globally consistent pay mixes generally use the following principle: “Pay mix is based on uniform job design and is globally consistent.” These companies typically cite one or both of the following reasons to support their practice. First, they prefer to drive one global job and associated sales compensation design. And second, a consistent worldwide approach to pay mix provides ease in communication and administration.

Most companies that vary pay mix by country use two practices:

- Local discretion. Provide a pay mix range and let the local country managers determine the right pay mix for their country. Challenge: Management discretion might allow a local manager’s personal bias to be the basis of pay mix decisions. Thus, it may change when leadership changes.

- Prescribed local pay mixes. A corporate function selects pay mixes for each role in each country. Challenge: This effort requires extensive corporate oversight, making managing, tracking and communicating complex.

Globally consistent pay mix practices have their issues, too. Local management may struggle to recruit and retain local talent if base salaries are too low. Conversely, when the target incentive is too low, earning upside rewards becomes difficult. One way to solve these issues is by creating a predefined pay mix structure.

Develop a Pre-Defined Pay Mix Structure

A predefined pay mix structure provides corporate direction while allowing local adjustments. Here are the steps to create a predefined pay mix structure.

STEP 1 Gather Market Data.

Businesses may gather from many sources of international market pay mix data. Similar to a pay level benchmarking exercise, companies should select a data source that includes a data cut for their industry and/or companies where they compete for labor and product. Many companies purchase a custom cut of the market data, which includes a specific set of target companies to improve their data’s relevance.

Large companies source multiple data sources to improve the accuracy of their data. After selecting the data source, companies choose the market job matches and countries pertinent to them. Then, they pull the pay mix data for those jobs/countries by examining actual incentive payouts compared with base salaries.

STEP 2 Group Jobs by Degree of Persuasion.

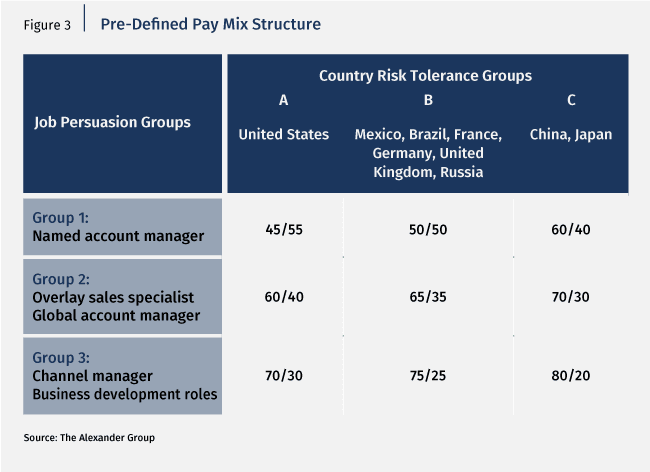

Group jobs by level of persuasion and influence on the purchasing decision. Companies use market data to guide their grouping. However, they should recognize the unique attributes of their go-to-customer model and sales responsibilities. The following represent example job groups:

- Job group 1. This group includes jobs with the highest level of persuasion, such as the named account manager.

- Job group 2. This group includes jobs with medium levels of individual persuasion. These may include the overlay product specialist (who works across a region of named account managers) and global account manager (who has to rely on a team of sales and nonsales resources to complete a sale).

- Job group 3. This group includes jobs with lower levels of persuasion, such as the channel manager (who relies on partners to close deals) and business development role (strategic role focused on evangelizing the solution that leads to specific larger opportunities, but not responsible for closing the deal).

STEP 3 Group Countries by Level of Risk Tolerance.

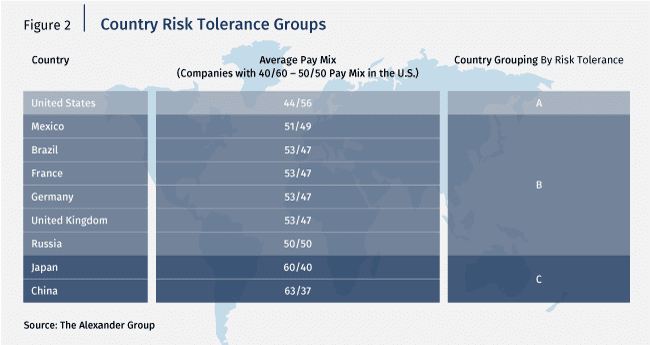

Gather the pay mix data by country for the primary, most populated sales role. Next, sort the data by market pay mix and assign each country to a group. Figure 2 includes the survey results for U.S. named account manager roles with 40/60-50/50 in the Sales Compensation Trends Survey. Note: The data suggest six pay mixes to be used by nine countries. However, the goal is to consolidate the data into a simplified and directionally appropriate structure for each included country.

STEP 4 Set pay mix for each job and country group based on individual influence and market practices.

Create a matrix including each job persuasion group and each country risk tolerance group. Then, leveraging the market data, fill in the boxes. Because Figure 3 uses the market data for the named account manager in Job Group 1 to define the country risk tolerance groupings, the rounded pay mixes for each country group are populated into the first row. Leveraging market data for the roles included in job persuasion groups 2 and 3, the pay mixes for these two rows are populated (data in chart is an example).

Simplicity vs. Complexity

Some practitioners err on the side of simplicity and, therefore, may design a limited pay mix structure. Other practitioners err on the side of exactness and, therefore, may design a complicated pay mix structure. The structure must accommodate local market needs. It must also be simple and easy to communicate, explain, administer and govern.

Pay Mix Transition Strategies

After setting a predefined pay mix structure, companies should complete a gap analysis by comparing their current participants’ pay mixes with the new predefined pay mixes.

Next, determine the appropriate transition strategy to align their current participants to the new structure. When considering the best transition strategy, companies should consider the competitiveness of the participants’ pay levels and their ability to articulate a compelling business case for change.

Lastly, do not forget to comply with country regulations that limit base pay changes. The following lists provide the most common transition strategies depending on the type of change:

Migrate to more pay-at-risk (e.g., 80/20 to 60/40)

- Cold cut. Move base salary to target incentive.

- Cold cut with pay change. Move base salary to target incentive. However, increase overall TTC to soften the transition (generally used when TTC levels are below market).

- Recoverable draw. Provide a nonguaranteed draw equivalent to the difference between the new and the old base salary for a specified period (e.g., $5,000 recoverable draw per month for six months).

- One-time payout. Provide a one-time payout equivalent to the difference between the new and old base salary.

- Migrate over time. Migrate individuals to new pay mix over time (e.g., convert 5% of base salary to target incentive each year for four years).

- Migrate with merit increase. Add all future merit increases to the base salary until individual reaches the new pay mix.

- Grandfather. Grandfather the individual at the old pay mix.

Migrate to less pay-at-risk (e.g., 60/40 to 80/20)

- Cold cut. Move target incentive to base salary.

- Cold cut with pay change. Move target incentive to base salary. However, increase overall TTC to soften the transition (generally used when TTC levels are below market).

- Recoverable draw. Provide a nonguaranteed draw equivalent to the difference between the new and old target incentive for a specified period (e.g., $5,000 per month for six months).

- One-time payout. Provide a one-time payout equivalent to the difference between the new and old target incentives.

- Migrate over time. Migrate individuals to new pay mix over time (e.g., convert 5% of target incentive to base salary each year for four years).

- Migrate with merit increase. Add all future merit increases to the target incentive until individual reaches the new pay mix.

- Grandfather. Grandfather the individual at the old pay mix.

What’s Right?

When it comes to sales compensation design, many opinions exist even for an aspect as straightforward as pay mix. Letting each leader decide what’s appropriate for their teams will inevitably lead to a wide range of pay mixes and potential downstream problems. Applying a one-size-fits-all global structure may cause recruitment and retention issues. Benefits to confirming with leadership the company’s pay mix philosophy and developing a predefined pay mix structure include:

- Pay mixes aligning with the role’s degree of persuasion

- Market–competitive pay mixes to attract and retain the right level of talent in local markets

- Principle-driven solutions as opposed to leadership whims

- Programs that are easy to communicate, administer and govern

How Alexander Group Can Help

We offer fact-based consulting in areas like sales compensation. These insights support pragmatic decision-making. Informed businesses are empowered to find a pay mix suiting each country of sales and match a role’s required degree of persuasion. Companies will see results like growth in sales by backing solutions with research.

Need Help?

Our sales compensation leaders compare existing plans to market research and our robust industry benchmarks. Alexander Group also assesses current practices to align changes with unique objectives. We then orchestrate design and implementation. Our team uses this process to make each tailored, planned solution a reality and deliver results. We can help with all elements of your sales compensation program.