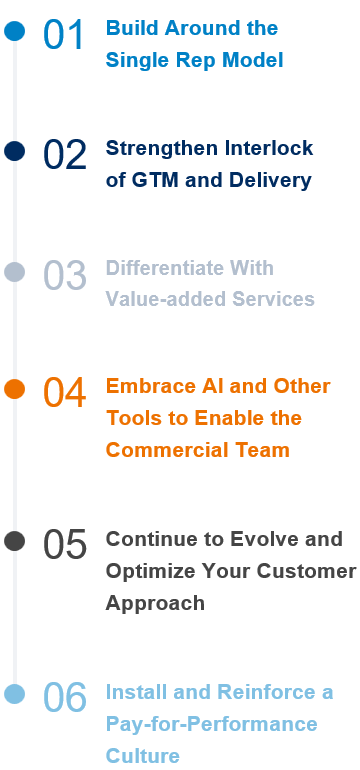

Six Go-to-Market Imperatives

With an eye on achieving these double-digit growth targets, there are six go-to-market imperatives for go-to-market models for healthcare vendors and suppliers:

1. Move beyond single rep models

Diversify the go-to-market strategy to include various roles such as customer success managers (CSMs), business development representatives (BDRs), and technical specialists.

2. Strengthen go-to-market and delivery interlock

Ensure that the customer journey extends beyond the initial sale to include implementation and ongoing support, emphasizing customer experience.

3. Differentiate with value-added services

Augment products with services that support HCPs and address broader provider challenges.

4. Embrace AI

Integrate artificial intelligence into enablement plays for sales, marketing, and customer service teams.

5. Continuously evolve commercial models

Stay agile and adaptable to keep pace with the market and outperform static competitors.

6. Adjust sales compensation strategies

Align compensation with broader commercial strategies and drive desired behaviors to support the high-growth model.

Industry Go-to-Market Imperatives Begin with Upstream Elements and Culminate with Sales Compensation