New Journeys, New Solutions - Part 2

Realigning Sales, Service and Operations to Serve the Evolving Buyer’s Experience

Buyers now expect a B2C experience for their B2B purchases. They have grown accustomed to the ease of an Amazon-like process where they can research what they need, review the offerings and use a one-click method to purchase products. Delivering this customer experience (CX) is new for chemicals & specialty materials manufacturers and distributors. This change requires them to invest in technologies that deliver greater value. The new digital buyer journey investments include e-commerce capabilities, digital advertising and customer support to provide customer satisfaction.

However, B2B customer sales are highly complex and requires expertise in Sales, Support and Service that a digital experience alone cannot provide. Clients need customized offerings and rely on manufacturers’ and distributors’ knowledge to offer much more than a self-serve experience. This buyer journey requires core sellers, account executives (AE), account managers (AM), customer success manager (CSM) and technical service experts to solve complex problems.

Buyers have multiple needs, and manufacturers and distributors must know how to deploy the right combination of resources to support each type of sale. This article will cover the ways that deploying the right types of coverage while investing in the right resources helps leading organizations improve the customer buying experience and consequently drive conversions.

What Is the Buyer Experience?

The buyer experience is your customers’ general perception of the purchasing process they undergo when working with your business or others in your industry. Understanding the customer purchasing experience will require your business to consider the buyer’s perspective at all stages of the buying funnel. This customer journey may be only a few steps or it may include hundreds, but today’s market demands that you ensure the best buying experience from start to finish regardless of that journey’s complexity.

Buyer experience is similar to customer experience in many ways, but they are distinct concepts. When assessing and improving the buyer experience, your leadership will focus primarily on converting new buyers as opposed to retaining existing customers. Optimizing the buyer’s experience involves shifting policies and practices in order to meet buyers’ needs at every step of their journey.

The Evolving Buyer Journey and the Value of E-Commerce

Customers’ expectations continue to grow. They expect frictionless digital purchase capabilities that make it easy to navigate and buy desired products for routine transactions.

If sellers cannot provide an e-commerce portal, buyers will find competitors that offer the online shopping experience they need, potentially taking more significant business opportunities with them to the new seller.

E-Commerce Benefits the End User

While competitive pressures make e-commerce a table-stakes offering for manufacturers and distributors, an e-commerce channel does provide an efficient and cost-effective way to serve smaller customers. In addition, manufacturers are now using creative e-commerce strategies that include investing in a single data lake for customer purchases rather than hosting multiple e-commerce sites for every seller or distributor. As a result, buyers benefit from speed and ease of use, manufacturers capture demand and efficiency, and distributors stay in the game ahead of their competitors.

E-Commerce Unveils Customer Segment Data

Today’s digital buyer journey supports routine transactions and prepares organizations for coming technological advances. Buyer persona-driven transactions and account-based targeted transactions drive upsell and cross-sell opportunities. Digital marketing programs, paired with e-commerce data, drive greater share and opportunities for both manufacturers and distributors.

However, not every customer is a digital customer. For some buyers, only a fraction of their total purchases will be performed online. Some buyers will continue to need a full array of support from core sellers, CSMs and service experts to solve complex problems. Because the spectrum of buyer purchase options is expanding, manufacturers and distributors will benefit by segmenting their customers. Segmentation allows companies to offer multiple sales coverage models, investing the appropriate number of resources where needed.

Manufacturers and distributors are using customer segmentation as a best practice to invest resources where there is the greatest opportunity. They recognize that buyer journeys are changing, and the sales models required to support them must align with the magnitude of the opportunity.

Evolving the Sales Mindset: The ILAER Sales Model

As the buyer journey evolves, so do the sales motions required to support their new path. The software industry was one of the first to adopt a Software-as-a-Service (SaaS) model, later evolving to an Anything-as-a-Service (XaaS) model. This model reflects that selling is no longer a linear “access, persuade, fulfill” model of order to fulfillment but a circular model that allows sellers to embed their products into the buyer’s operations. Instead of a one-time sales or renewal motion, sellers are encouraged to Identify → Land → Adopt → Expand → Renew products, or the ILAER approach.

The shift from the traditional order-fulfillment model to the ILAER model is a good fit for software, service and products that are “sticky,” provide value and are integrated into the buyer’s operations. Because of the model’s widespread success, manufacturers and distributors have adopted the concept of ILAER and adapted it to create highly efficient sales models that drive recurring revenue or increased customer lifetime value.

ILAER Benefits

Recurring revenue and customer lifetime value are benefits of the ILAER model. As software companies switched from legacy, server-based systems founded on long-term renewals with a high CAPEX outlay, they adopted a subscription-based approach that makes costs more predictable for buyers while creating recurring revenue for sellers. The Adopt – Expand – Renew cycle of subscription software sales led to expansion through upselling and cross-selling, resulting in increased sales and value proposition.

Manufacturers invest in the ILAER model to create valuable end-to-end service propositions with sellers, supporting the model by deploying targeted resources that enhance customer relationships while revealing new expansion opportunities. The ILAER sales model is highly efficient, helping to build service offerings and expansion opportunities. By strategically deploying resources, companies have been able to achieve a gross margin of 40% for traditional manufacturers and 43% for advanced manufacturers, and experience a 4% to 8% expense-to-revenue ratio.

ILAER for Chemical Manufacturers

Chemical manufacturers use the ILAER model to land an account with a leading product while providing resources to ensure adoption. During the expansion phase, manufacturers deploy specialist resources to sell additional applications while still driving product usage. These advanced manufacturers staff a ratio of 6.6 sellers per product/vertical specialist, a 10% greater investment than industry average. Engaging with end-users at plant sites is critical, helping to create and maintain the “sticky” relationship that fuels the Adopt – Expand – Renew cycle.

Adjusting for the ILAER Sales Model

Applying ILAER is a viable option for manufacturers and distributors willing to optimize their value proposition. To accomplish this, they will have to rethink their coverage models and the resources necessary to support the ILAER model.

Sales Coverage Becomes More Complex

The growing spectrum of buyer expectations coupled with the expansion opportunities of the ILAER sales model requires manufacturers and distributors to develop more diverse sales and support roles.

Digital engagement is here to stay. Not only do buyers require self-service e-commerce options, but sellers require digital marketing investments to monitor buyer purchases while recommending sales expansion opportunities.

Value-added services and seamless manufacturer and distribution collaboration are advantages of digital sales and marketing. Alexander Group research shows that 18% of manufacturers and 53% of distributors are making digital investments that include end-to-end customer tracking and fluid cross-departmental data sharing. Customer success and lead generation representatives are the most prevalent roles in managing this approach, helping manufacturers and distributors sell and gain qualified leads using this cost-effective sales model.

However, what is crucial for the chemical manufacturing model is application knowledge, an expertise unique to the industry and unavailable in an online environment. Overlay specialists are critical to both the manufacturer and the customer, providing as a valuable and knowledgeable support function that ensures adoption. The complexity of this sale requires this application expertise in addition to the efforts required to manage the diverse types of stakeholders involved in the agreement.

The Growth of Overlay Roles

Both digital and traditional buyer journeys require more roles to support initial and recurring sales. Highly leveraged roles include enterprise-level account managers (AMs) who have multifunctional expertise to assist at various levels of sales and adoption roles. In addition, industry specialists can help craft unique solutions and value propositions while product specialists offer focused expertise. Both manufacturers and distributors frequently use these specialist roles and may include a specification seller who influences early-stage buyers, including OEM sales.

Service reps are another key overlay role that supports sellers. Their knowledge of customer pain points, daily product use and other solutions enhance CX while helping sellers to remain on the lookout for expansion opportunities. Service reps create relationships at the plant site, earning the trust of customers while providing ongoing information that is valuable for the entire organization.

These overlay and specialist roles have a decided advantage in the manufacturer-distributor relationship. Manufacturers may provide dedicated or overlay specialists, while distributors can provide complementary roles and expertise. Manufacturers offer training and technical specialists that benefit distributors who then use the information in the field as they coordinate sales processes and product introductions. The combination of valued partnerships and specialist expertise provides value-add for buyers at any stage of the journey.

Rethinking the Economic Model to Implement ILAER

Implementing the ILAER model will require your organization to explore new investments and strategies.

Create the Building Blocks

Digital offerings, overlay roles and customized buyer journeys are the way forward for manufacturers and distributors. But they do require investment, coordination and partnership to be successful.

The ILAER sales model has proven successful for software sales but is also applicable for manufacturing and distribution. The key to implementing the model is to transition from the linear mindset of “order to fulfillment” to a circular model of continuous adoption, expansion and renewal. It requires manufacturers and distributors to embed not only their products but the products’ value propositions into the buyer’s enterprise. It is the value they derive from related products that make the ILAER model successful.

Tying Expansion to Adoption

The adoption phase, measured by product usage, is critical to Customer Success. Successful adoption helps the seller embed the value proposition into the buyer’s organization, increasing opportunities for expansion and renewal. Where the Identify and Land motions of the ILAER sales model are initiated by the core seller and supported by service expertise, the AM, CSR and service roles are critical to the Adopt → Expand → Renew circular phase. These roles stay close to the customer throughout the initial adoption phase, providing support that ensures user acceptance while laying the groundwork for expansion opportunities, including upselling and cross-selling.

Upselling by Solving the Customer’s Needs

Upsell success requires proof that the initial adoption phase was productive. Success lies in demonstrating that the product solved an existing customer problem. Providing before and after metrics, testimonials or other evidence is also critical.

Upsell success requires that sellers have a detailed understanding of a buyer’s problem and can tie a specific solution to that problem. Customer success or service roles who maintain close post-sale contact with customers are most likely to spot buyer issues first. However, it is critical for these roles to communicate these opportunities to core sellers, AEs and AMs. Companies who use sales enablement tools, like CRMs, can provide the transparent communications needed for upsell opportunities across all sales-related roles.

Cross-Selling by Understanding Adoption

In addition to CRMs, companies enable their service organizations with advanced tools to better support customers and the selling function. According to Alexander Group’s latest Manufacturing & Distribution Industry Trends Research, the most commonly used tools in North America include web chat and call center platforms, currently used by over half of organizations. In addition, our research indicates that product usage tracking apps and processes that identify upsell and cross-sell opportunities are used by 26% of companies.

Providing Use Cases to Upsell and Cross-Sell

Expansion plays, including upselling and cross-selling, offer use cases as a proof point. Manufacturing and distribution use cases can include existing case studies within the buyer’s industry or newly created use cases that demonstrate a new value proposition. Traditional presentation approaches include offering use cases to lower-level buyers to solve existing problems or to executive buyers to support a longer sales cycle.

Sellers must craft an upsell opportunity as a solution tailored to the buyer’s pain point, being more effective if they offer a unique value proposition with a demonstrated ROI. Upsell options that offer generic or unproven products will typically fail without proof of previous success. Buyers have a B2C mentality and want proof that solutions work before they buy it, making it easier to sell the solution and adopt it within their organization.

AMs, customer success, service and specialist roles are the first to identify buyer problems since they are involved in the day-to-day customer activities. Therefore, training these resources to identify customer issues and offer potential upsell or cross-sell solutions is critical to expansion success.

Balancing Sales and Coverage

Companies are adding new selling roles and competencies to support the new buyer journey. However, these new roles must be thoughtfully designed and incorporated into the seller’s Revenue Operations strategy to serve customers and meet revenue and margin goals.

Core sellers typically own the customer relationship and have limited bandwidth to address all customers’ needs. Increasing seller turnover accentuates this bandwidth issue as experienced sales professionals leave the profession.

Adding Support Roles

Alexander Group’s Manufacturing & Distribution Industry Trends Research shows companies are reporting that over 10% of their sellers will retire in the next two years. Newer sellers want broader career paths yet need advanced technical and business acumen. Core sellers are an expensive and necessary investment but require supporting roles to ensure appropriate sales coverage.

AEs, AMs, customer success and service roles are just a few of the positions being added to the Revenue Operations function, resulting in a complex coverage model with diverse compensation programs. These roles are necessary for customer acquisition and retention and benefit from being lower cost than core sellers. As a result, Alexander Group’s research indicates that overall Compensation Cost of Sales (CCOS) has increased by 15% in the last two years as manufacturers balance sales, support and service roles for each customer.

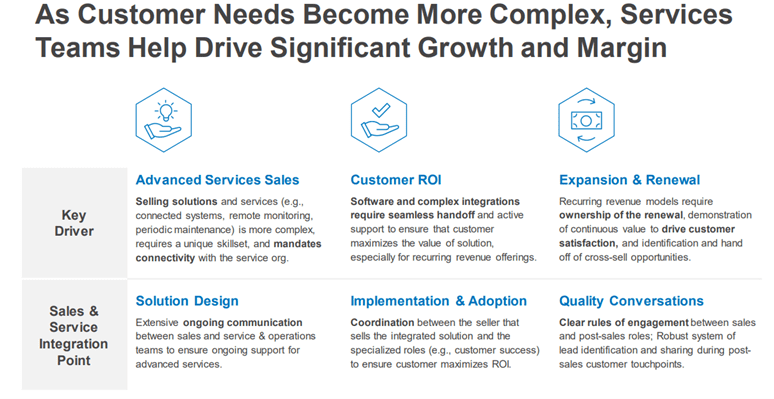

Manufacturers are using the ILAER strategic sales model to align their resources and maximize their margin. They are deploying sales, operations and service resources to match the type of product, customer and sales cycle integration point, as shown below:

The ILAER approach offers more specific skillsets, enhanced buyer adoption, customer retention and sales expansion at a lower cost to the selling organization. Skilled service experts are a core part of this model, bringing problem-solving and technical expertise to the table. As a result, per recent Alexander Group research, manufacturers are investing in training for all resources, increasing their training expense per seller by 30% to decrease ramp-up time by 25%.

Understand and Adapt With the Modern Buyer’s Journey

As the buyer’s journey for manufacturers and distributors evolves, organizations are implementing new resources that help them attract and retain customers.

In addition to digital sales operations, the selling strategy must also evolve from a linear order-fulfillment approach to a circular Identify → Land → Adopt → Expand → Renew (ILAER) approach that embeds the seller’s value proposition into the organization. This approach provides more value to the customer but requires manufacturers and distributors to implement highly coordinated Revenue Operations that includes sales, operations, application knowledge and service expertise.

The benefit to manufacturers and distributors is more expansion opportunities that use lower-cost resources while offering greater value to the customer.

Work With Alexander Group to Realign Sales, Service and Operations Roles

Designing a clear sales strategy that aligns with the ILAER approach takes expertise. Alexander Group helps manufacturers and distributors grow revenue while implementing leading operational models to help them remain competitive. Our leading research and benchmarks support our clients in achieving industry-leading high-growth and a sustainable place in the competitive marketplace.

For more information on how Alexander Group can assist you with your commercial strategy, please contact a Manufacturing or Distribution practice lead.