Tracking and Managing to the Right XaaS Metrics

New Alexander Group XaaS Study Findings

Today’s leading technology companies face many challenges in the new era of XaaS. As XaaS adoption accelerates, the question on every sales leader’s mind is, Are we keeping pace? As hybrid companies move towards XaaS, they face bookings and cost challenges due to smaller deals and an increased need for specialized sales roles. XaaS organizations face stiff competition from startups and hybrids and invest heavily in sophisticated post-sales models to retain and grow customers.

Alexander Group’s recent XaaS Sales Strategy Market Study reveals that, despite growing impact from post-sales investments, both Hybrids and pure XaaS firms struggle to optimize sales organizations to fit emerging XaaS buyer journeys.

Based on findings from 50+ XaaS executive interviews, the study details five critical XaaS leadership priorities for XaaS model optimization:

- Adapt revenue motions and roles to emerging XaaS buyer journeys

- Invest in digital engagement and roles to acquire and grow new customers

- Instill a culture of growth-oriented customer success

- Align talent profiles and incentive compensation with XaaS selling and

- Deploy and coach to new metrics/tactics for XaaS buyer journey optimization

The study also presents key XaaS benchmarks such as:

- Bookings and sales costs per seller

- Customer growth and account expansion rates

- Customer acquisition costs

- Coverage models and headcount ratios

- Salesforce turnover and seller ramp times

- Sales compensation design and pay levels

Adapting Revenue Motions and Roles to Emerging XaaS Buyer Journeys

XaaS is here to stay. Alexander Group’s recent study of over 60 high-tech companies shows that as a percentage of total revenue, recurring revenue now makes up approximately 90% of pure plays and over 20% of traditional Hybrid companies.

The XaaS business model centers on recurring revenue through either subscription- or consumption-based pricing. Because of this, recurring revenue business models require tech vendors to engage customers in a new way. Namely, in today’s world, tech companies need to have a continual, ongoing relationship across the entire customer life cycle. The relationship should feel seamless to customers whether they are dealing directly with vendor representatives, partners or digital interaction.

The question for XaaS vendors is, what are the optimal marketing, sales and service motions within XaaS environments? In addition, where and how should XaaS vendors focus their efforts in order to best meet customer expectations? The illustration below (click for larger image) attempts to map the customer life cycle with their vendor from two perspectives: The perspective at the top is from the buyer point of view; the bottom perspective is from the vendor point of view.

Ultimately, best practice is to ensure alignment between these two perspectives and verify successful execution of all roles and resources a vendor brings to bear. As a XaaS vendor, this means adapting outbound activities, processes, roles and coverage that meet the needs of XaaS customers and buyers. While most XaaS vendors are currently in the process of designing and executing their new ILAER strategies, many open questions remain, as do many choices regarding revenue motions, roles and coverage. It’s a discussion well worth having.

Pre-Sales Investment in New Roles and Tools Expands in 2019

Pre-sales investment in new roles and tools is up big!

The boost in investment is in response to changing—and increasingly digital—customer preferences across the ILAER buyer journey. According to the participants in Alexander Group’s XaaS Sales Strategy Study, more than 15% of all deals originate digitally.

Companies are exploring ways to boost value for buyers who are increasingly more informed about their choices, less patient in terms of time to realized value and more willing to self-serve. The summarized new buyer purchasing mandates are: extract maximum value, try before you buy, pay for usage only and incur OPEX (operational expenditure) over CAPEX (capital expenditure).

To meet those demands, companies are investing in customized, easily consumable content, robust IP/advocacy programs and ways to deliver instant, high value. The digital prospect engagement funnel is a framework that helps companies ensure they are deploying the right digital roles and tools in this portion of the buyer journey. It starts with self-learning and ends with activation.

The funnel has both self-driven and company-driven stages. And much like most of the overall buyer journey—particularly in the ‘Land’ phase—engagement is typically non-linear and non-sequential. The five stages are:

SELF-DRIVEN Stages

1. Self-learning: Buyers demand customized content in easily consumable formats to make informed decisions. For basic products or solutions, buyers expect to complete the transactions in a self-service model with limited bureaucracy (remember, the stages are non-linear and non-sequential).

2. Community validation: Buyers confirm and validate their choices by engaging a variety of digital outposts including forums, blogs, references, and partner- and company-sponsored content.

COMPANY-/SELF-DRIVEN Stages

3. Instant value: Buyers demand technical and concierge support to drive instant value (e.g., assessments and insights on their data). Use of digital chat is ubiquitous. Email, and telephone/voicemail to an even greater extent, are widely regarded as too slow.

4. Trial options: Buyers expect customized solutions based on trial and proof of concept (POC) results. POC timelines are shrinking for all but the most complex enterprise-wide solution trials. Sixty- and 90-day trials are now the exception.

5. Activation support: Buyers want support in activation and a smooth ramp time. Companies increasingly provide Customer Success Managers to ensure a smooth transition from sales to service.

Successful companies are adapting to changing buyer preferences. They are meeting buyer expectation in terms of where and how they want to buy—providing value across each of the five digital prospect engagement funnel stages.

Instilling a Culture of Growth-Oriented Customer Success

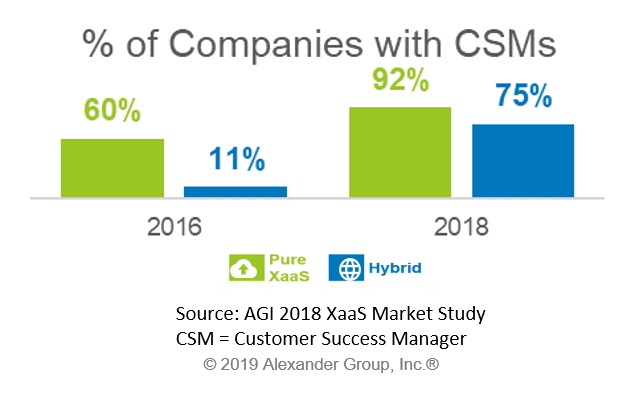

Customer Success has gone mainstream. According to Alexander Group research, the percent of companies utilizing the Customer Success function increased from 60% to 92% for pure-plays and from 11% to 75% for hybrids between 2016 and 2018. What’s driving this rapid shift? The answer lies in the collective perception that—despite uncertainties—an enhanced CSM role is critical to sustained bookings and revenue growth.

While utilization is now common across the technology landscape, the design, deployment and execution of the Customer Success function varies substantially from company to company. Alexander Group reported on this variance previously, and our recent experience working with technology organizations suggests little has changed. Usage and adoption remains at the core of Customer Success. However, significant debates continue regarding the function’s role in land, expand and renew sales motions as well as appropriate forms of remuneration to guide and motivate Customer Success personnel. Questions are plentiful, yet one thing is clear: instilling a culture of growth-oriented Customer Success is a principle that should guide all organizations with recurring revenue models going forward.

While utilization is now common across the technology landscape, the design, deployment and execution of the Customer Success function varies substantially from company to company. Alexander Group reported on this variance previously, and our recent experience working with technology organizations suggests little has changed. Usage and adoption remains at the core of Customer Success. However, significant debates continue regarding the function’s role in land, expand and renew sales motions as well as appropriate forms of remuneration to guide and motivate Customer Success personnel. Questions are plentiful, yet one thing is clear: instilling a culture of growth-oriented Customer Success is a principle that should guide all organizations with recurring revenue models going forward.

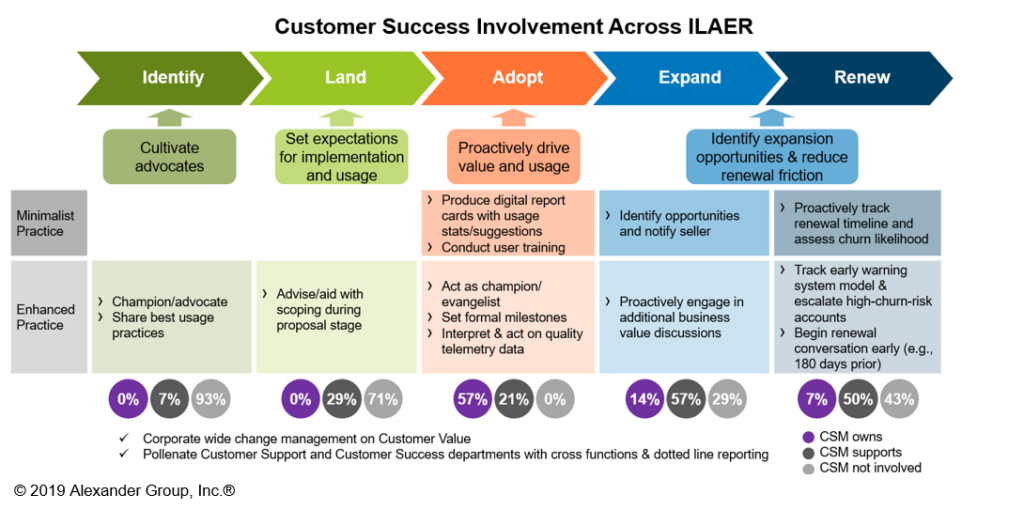

As part of our XaaS Market Study, we uncovered mission-critical actions companies must take to yield strong returns from increased investment in Customer Success. The clearest step is moving from minimalist to enhanced practices across the ILAER spectrum.

Enhanced Practices:

Identify: While CSMs generally spend the least amount of their time in the Identify phase, their deep comprehension of product use cases and business outcomes can drive more “top-of-funnel” opportunities. Leading companies employ Customer Success to share best usage/adoption practices and document notable use cases in self-service content (e.g., blogs, articles, etc.) and interactive forums for prospective buyers. Furthermore, CSMs share key use case insights and anecdotes with lead generation reps (SDRs) to enable them to better qualify prospects.

Land: CSMs do not own the Land phase as the traditional sales representative is still the primary resource for securing new accounts. However, more companies are inserting CSMs within targeted stages of the sales process to set the right expectations from a solution feature perspective and more importantly, lay the foundation for seamless activation. A positive activation experience has major downstream impact on retention rates, so companies are motivated to provide transparency to its prospects on how the activation process will work before, not after, the sales process is completed.

Adopt: Telemetry data is huge. Virtually every company is focused on how to collect product usage information. Leading companies educate CSMs on how to interpret usage information that will 1) allow them to augment or upsell on customers’ feature usage, 2) capture ways to improve customer experience and utility, and/or 3) identify at-risk renewals early in the process.

It is also imperative that CSMs establish a set of adoption milestones that are mutually agreed to by their customers. Milestone examples include: completing all training courses, conducting the first QBR and achieving 100% seat activation. Achievement of customer-specific milestones is critical to building a solid relationship in Year 1. And then the cycle starts again. A new set of milestones must be developed, some of which will differ from the original set as customer needs will vary from year to year as its product needs and vendor experience evolve.

Expand: The best CSMs don’t simply sniff out an upsell or cross-sell opportunity and “throw it over the fence” to the sales team. High-caliber players will proactively engage in business value discussions with users and decision-makers. They stay contemporary on industry trends and customer news, and subsequently make connections on how their products and services impact customers’ business performance.

Renew: Many Alexander Group clients are at the beginning stages of deploying early warning systems to stave off dollar and customer churn. Leading organizations instruct CSMs to monitor these systems regularly. They proactively work with their customers to navigate roadblocks that prevent customers from realizing expected value. Leading companies are also developing and executing a much longer renewal playbook; we saw a lot of “30-day renewal plans” a couple years ago, but now we hear “90- and 180-day renewal plans” with increasing frequency. Playbooks are also becoming more sophisticated where Customer Success organizations leverage a diverse set of plays ranging from complex (e.g., tiger teams focused on big, at-risk renewals) to straight forward (e.g., auto-renewals). The key is driving each customer into the right play. CSMs accomplish this by leveraging early warning systems and initiating the renewal process much earlier in the customer cycle.

The message of 2019 is clear: move beyond minimalist Customer Success practices. Take the steps today that will ultimately lead your company to having a culture of growth-oriented customer success.

Aligning Commercial Talent To Drive XaaS Growth

Misalignment between commercial (sales, marketing and service) talent and incentive compensation can compromise even the most thoughtful XaaS growth strategies.

Across the tech industry, companies struggle with finding the right talent and retaining the required talent to drive profitable revenue growth. The demands of the XaaS market and customer base often render traditional compensation programs ineffective. How then can Pure Play XaaS companies and Hybrids transitioning traditional models to XaaS effectively align their talent and compensation programs to compete in an increasingly crowded marketplace? This article will examine strategies that market leaders use to cultivate the right commercial talent; a later article will more fully address the required adjustments to compensation programs.

Finding the right sales, marketing and service talent to guide customers through the ILAER (Identify, Land, Adopt, Expand, Renew) journey is the most critical element of success in building sustainable XaaS revenue. Companies, especially hybrids, must confront the difficult reality that XaaS requires different skill sets, experiences and capabilities from talent than traditional tech models. Effective XaaS performance mandates robust use of social and digital media; faster sales cycle times; absorption of more numerous, smaller ACV deals; an increased number of active opportunities; much deeper customer engagement post-sale; and maniacal focus on renewals and expansion. Hybrid companies inevitably realize, often later than they would like, that many team members successful in the perpetual, on-premise world are ill-equipped to adapt to the XaaS model.

Tech turnover is currently running at double the normal industry rate (~20% vs. ~10%), and a disproportionate amount of that turnover is voluntary. Some of this turnover is attributable to low macroeconomic unemployment, particularly in the U.S.; however, there is no question that there is fierce competition for talent in the industry and companies are poaching top talent from one another. As coverage models change, many roles are in increasingly high demand: customer success reps, digital lead development reps, account executive, hunters and account managers.

Leading tech companies are addressing talent issues in many different ways, including:

- Ensuring Roles Are Well-Defined: Revisit existing job descriptions to ensure they are contemporary and define current and future requirements. Document expectations and requirements for new roles.

- Building Detailed Competency Models: Define an aspirational set of skills and capabilities required to perform a particular commercial job that individuals can demonstrate through observable behaviors and actions. Create a continuum of growth and development within each role to provide avenues for individuals to advance their careers. Conduct self and manager assessments once or twice per year to determine areas of strength and personal development objectives. Map particular skills directly to training modules so that individuals can address gaps in their development. Use competency models as a guide to identify suitable candidates for commercial jobs.

- Providing Clarity Around Career Path: In a recent industry study, the most consistently cited reason millennials leave their jobs is lack of clarity around opportunities for advancement. It is important to note that this group, an increasingly important element of the modern tech commercial landscape, typically does not want immediate or undeserved advancement; instead, they want clarity around the process to progress from individual contributor to management to executive. Leading companies provide this visibility via competency matrices like those mentioned in #2 above and through mentoring programs with established company managers and executives.

- Assessing Incumbent Talent Dispassionately: This can be difficult. Many companies fall into the trap of redesigning commercial organizations with current talent in mind rather than taking an aspirational approach. Leading companies design go-to-customer models irrespective of current headcount and capabilities and objectively assess existing talent to determine potential gaps. Some individuals can transition to the XaaS environment, while some will struggle to adapt. Organizations with a thoughtful, objective approach can more effectively manage risk to create desirable turnover and fill the resulting gaps more quickly.

- Avoiding Rounding Up the Usual Suspects: It is very common in this high turnover environment to encounter commercial resources that have bounced across multiple companies within the industry. This can be an indication that an individual was successful in the traditional tech paradigm and is struggling to adapt to the XaaS model. A best practice that top tech companies often cite is looking outside the industry to find new talent. There are many industry verticals that have significantly more history than tech operating recurring revenue models such as telecom, business services, information services, healthcare and distribution, to name a few. Often, potential hires from these industries will consider less senior roles at lower pay levels to break into the tech industry without direct experience.

- Investing in Mechanisms (Other Than Compensation) to Attract and Retain: For commercial talent (particularly sales), incentive compensation will always be a big part of the equation. (We will address sales compensation strategies in a future blog.) Irrespective of compensation, Alexander Group’s research suggests that leading companies utilize multiple tools to make commercial positions more attractive to both incumbents and potential team members. Leading companies invest in non-compensation levers that make employment more attractive, such as enablement (including leads), recognition programs, training and professional development and specialist/technical support.

Finding and retaining top talent will continue to separate winners from losers in the XaaS market. Leading companies recognize that even in a digitally obsessed world, commercial success still inexorably depends on driving better customer experiences with people who can provide customers and prospects with the information and expertise they expect from a valued vendor and trusted partner.

Tracking and Managing to the Right XaaS Metrics

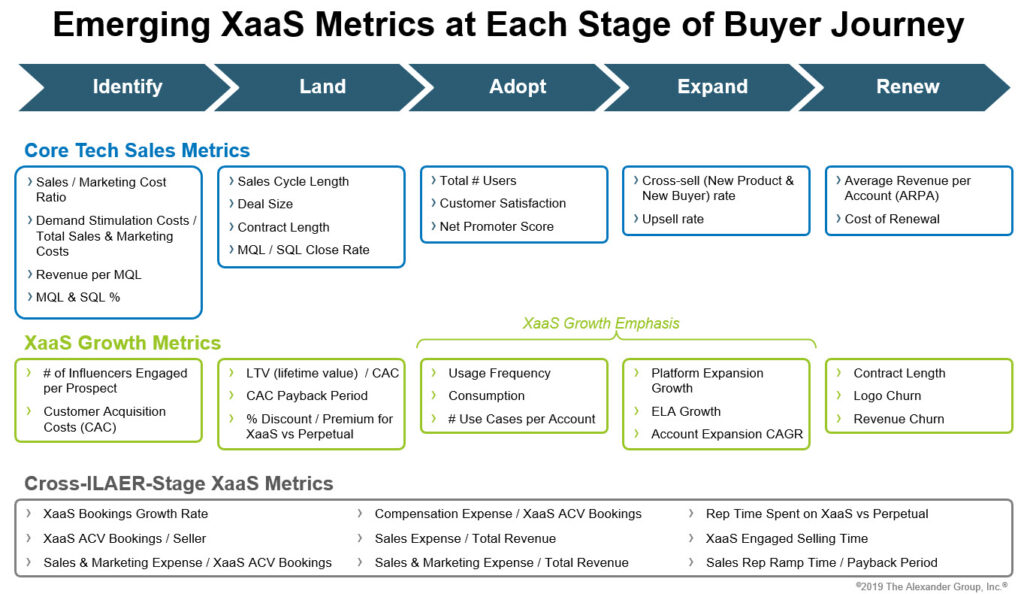

For growth-oriented XaaS companies, tracking and managing to the right XaaS metrics is a crucial piece of the puzzle. As leaders hone new skills, such as customer adoption, they must learn which metrics tie to positive (and negative) business outcomes.

The recent XaaS market research helped us identify the XaaS metrics that companies track, and where they fit into the buyer journey. As shown in Figure 1 below, we arrayed them across the ILAER buyer journey to better depict how metrics align with various stages of the sales process. We found that leaders track key metrics at each stage of the ILAER buyer journey to measure performance and productivity, as well as efficiency and profitability. They also track cross-ILAER metrics to monitor overall business results.

One insight from this analysis has been particularly fascinating: XaaS companies regularly track upwards of 50 metrics to manage their XaaS buyer journeys!

But not all leaders have the time to regularly track and manage to 50+ XaaS metrics. So, we’ve selected the most crucial metrics and placed them into four key categories. Read below to learn more about these crucial metrics and what they mean for your XaaS business.

1. Identifying and Landing New Customers: It’s all about CAC

In a recurring revenue world, landing a new customer can be difficult and costly. Knowing when your business will achieve ROI on that investment is crucial. As such, companies track Customer Acquisition Cost, also known as “CAC,” [or the cost of marketing and sales personnel and programs dedicated to acquiring new customers, divided by the number of new customers, or CAC Cost of Sales, which divides Cost by new customer ACV bookings or margin.] Factors influencing CAC include deal velocity, deal size and the number of specialists and support resources involved in any given sale. Companies with lower CAC tend to have higher deal sizes and/or lower cost resources (such as inside sales). Companies with higher CAC tend to bet on strong expansion (“post-sale”) growth and long-term relationships with customers. Having a higher CAC is not always bad; the key is ensuring customer stickiness (retention) and growing customer spend through successful adoption, retention and expansion.

2. Adopting and Retaining Existing Customers: Plugging those pesky leaks

Given how difficult and costly acquiring new customers can be in a recurring revenue model, companies are now placing greater emphasis on retaining their existing customers. Companies now use new adoption metrics, such as usage frequency and number of use cases per account, as well as sophisticated telemetry data (e.g., number of users, average usage time per product per user, support tickets submitted) to track adoption and predict churn. Many companies also track Net Revenue Retention (NRR) to monitor the success of adoption and retention efforts. NRR measures revenue retention and expansion for existing customers by comparing average monthly recurring revenue year over year. When NRR is below 100%, the company has a “leaky bucket” problem, and is failing to make up for it by driving cross-selling and upselling. Through successful adoption, companies can often fix the leaky bucket problem. But to obtain a healthy NRR, they must successfully adopt, retain and grow their existing accounts.

3. Measuring and Improving Overall XaaS Health: Growing Customer Lifetime Value

Beyond CAC and NRR, leaders must analyze the productivity and efficiency of the entire organization to best gauge overall XaaS health in the short and medium term. The most informative way to measure productivity is to report Growth ACV (Annual Contract Value) Bookings per Seller, which is the average growth license bookings (from landing new accounts and expanding existing accounts) that each seller brings in each year. Companies typically track this on an ACV basis, to normalize for varying contract lengths. Companies transitioning from perpetual license selling to XaaS can see growth ACV Bookings per Seller decrease, as the first-year value of contracts declines. The positive side effect of the transition is that companies gain recurring revenue customers that, with ongoing nurturing and adoption, can become reliable, long-term revenue sources.

To make important short- and medium-term model improvements, XaaS leaders also find it crucial to understand sales force efficiency, and look to Sales Expense to Revenue (or E/R) as a key indicator. Although lower E/R indicates higher efficiency, it can also be a sign of underinvestment. Increasing investment in the right roles or tools can yield exponential results in new sales, customer retention or expansion selling.

To evaluate productivity across the customer journey and across time, companies turn to another metric: Customer Lifetime Value (CLV), which is the revenue a customer brings in over the years they continue to (or are projected to) purchase the service. CLV, along with CAC, provides a comprehensive view into long-term profitability, by comparing the cost of acquiring a new customer to the total revenue that customer will bring in.

4. Balancing Profitability and Growth: the Hallmark of a Best-in-Class XaaS Organization

Leading XaaS firms effectively balance profitability and growth, as measured by the Rule of 40. The Rule of 40 states that publicly traded XaaS companies with a combined annual revenue growth rate and EBITDA margin above 40% comprise 80% of market capitalization for all XaaS (source: Piper Jaffray’s 2018 software market review). Companies that execute well on efficiently acquiring new customers, retaining and growing existing accounts, and driving high CLV offer themselves the best chance at balancing profitability and growth, and consistently outperforming the rule of 40.

Growing in a recurring revenue model requires a holistic understanding of your buyer journey. As the metrics landscape evolves, XaaS leaders must continue to track and make decisions on key metrics that are right for their businesses.

To learn more about tracking and managing the right XaaS metrics, schedule a briefing of our latest XaaS research findings.