Reinforcing a Focus on Profitability Via the Sales Comp Plan

Three Tactics Revenue Leadership Can Use to Drive Profitability

Profitability metrics were rarely used in compensation plans when manufacturers focused on growth and market share expansion. At most, some organizations elected to include a profitability metric in sales leaders’ plans to drive pricing and discount discipline.

However, as manufacturers now focus more on driving profitability in this macroeconomic environment, it begs the question of how companies should cascade this focus down to the sellers through the sales compensation plan. We will explore three tactics revenue leadership can use to drive profitability via the sales compensation plan with varying degrees of emphasis. These include:

- Product Mix Elements

- Core Revenue Measurement Modifiers

- Standalone Profitability Measures

Tactic 1: Manage Profitability Via Product Mix

The two profitability levers a sales organization uses are product mix and price realization, as cost is typically out of their control. This tactic drives profitability via product mix by incentivizing sellers to focus on a particular set of products and solutions with higher margins.

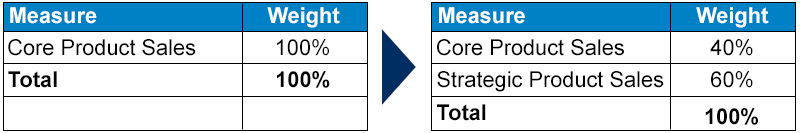

Organizations can allocate a specific percentage of the target incentive to a strategic products bucket rather than including all product sales in one single measure. This approach allows organizations to pay different comp levels for a bucket of higher-margin products.

At times, electing a standalone strategic measure may lead to less focus on lower profit, yet higher volume and/or highly strategic products and services. Therefore, a careful choice of measure weightings in relation to their revenue representation and a strong management cadence are two important mitigation factors to avoid such unintended consequences.

Tactic 2: Include a Modifier on Core Revenue Measure

Some organizations decide to include an explicit profitability metric in the compensation plan as a modifier of the core revenue measure. This approach will drive a focus on profitability across two levers: product mix and price realization.

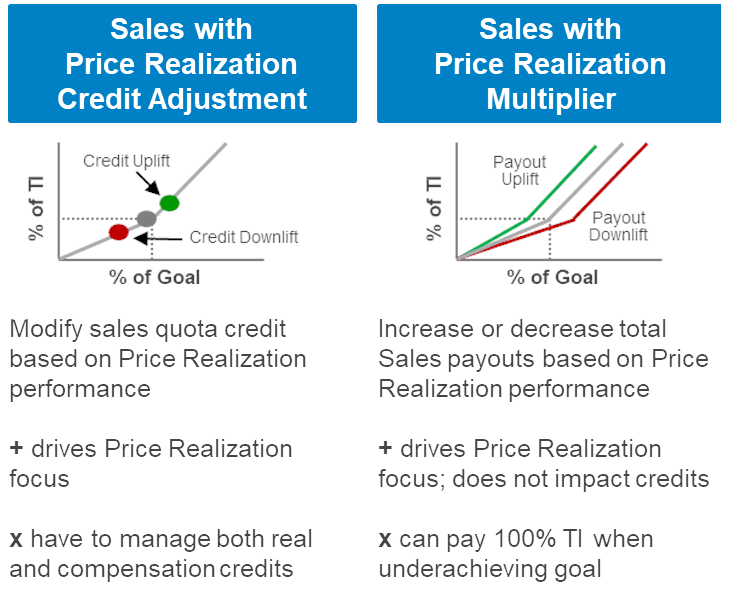

There are two ways an organization can modify core revenue. They can 1) increase the amount of quota retired for higher margin deals/higher price realization or 2) they can use multipliers to increase seller payouts. The advantages and disadvantages of these two approaches are shown below.

Both mechanics can be used as a carrot or stick, depending on how aggressively the organization wants to drive price realization and its need to fund the additional payouts for higher margin deals. In both approaches, the payouts need to ensure fiscal responsibility by modeling the expected percentage of deals falling in each category. Additionally, the organization must determine the true cost of the plan to ensure desired profitability levels.

Regardless of the plan mechanic choice, the biggest challenge with the core revenue modifier tactic is its on/off nature. One key attribute requires a threshold for higher margin deals vs. higher price realization to be defined. For example, if the organization establishes the threshold for price realization at a 10% discount, an order with a 9.9% discount will get the benefit. In comparison, an order with a 10.1% discount will be excluded. Moreover, the 9.9% discount order will get the same benefit as an order at the list price.

While the core revenue modifier is a successful tactic for improving profitability, it does require evaluating the relationship between comp plans and pricing strategies.

Tactic 3: Develop Standalone Profitability Measures

Organizations can elect to have a standalone measure to drive ample focus on profitability. When the standalone profitability measure is combined with a revenue measure in the sales comp plan, a profitability percentage metric, such as gross margin, is the preferred choice to eliminate the correlation between revenue dollars and profitability dollars. Standalone measures allow the revenue metric to reward sellers for sales volume, while the profitability metric will reward sellers for the profitability of the sales volume.

If an organization elects a standalone measure, there needs to be ample focus on setting quotas for the profitability metric. Additionally, to ensure that reps focus adequately on the probability metric, the weight must be meaningful, limiting the rep’s ability to shop the plan.

Drive Profitable Sales Behaviors

While profitability is very much at the forefront of the leaders’ minds, including it in the sales comp plan directly communicates to sellers that profitability is not just the responsibility of sales leadership. Organizations are able to use these levers to engage directly with sellers while driving behaviors that support business objectives.

Need Help?

For more information on how to drive profitability in your sales compensation plan, contact an Alexander Group expert.