2020 Sales Compensation Hot Topics Survey Findings

How did sales departments protect sellers’ pay during the COVID-19 crisis?

What plans are underway to restart sales efforts? Learn what sales leaders shared about these issues and more in the 2020 Sales Compensation Hot Topics Survey findings. Featuring 135 participants, the Alexander Group collected survey data in June and published the results in July.

Highlights

The 2020 Sales Compensation Hot Topics Survey provides contemporary findings on the following key topics:

- COVID-19 Pay Protection. 64.2% of the companies will make changes to sellers’ compensation due to COVID-19. For companies where the negative impact on revenue was greater than 15%, 70.8% of the responding companies will provide some form of partial incentive compensation pay protection. The common method is a pay guarantee, but other techniques are prevalent too.

- Restart Techniques. Half of the companies plan to provide additional seller and buyer incentives to help restart sales.

- Recurring Revenue. Account managers and territory representatives are frequently responsible for renewal revenue. Half of the companies treat new and renewal revenues the same for compensation purposes. For the most part, revenue crediting occurs at time of sale regardless of contract expiration date.

- Program Implementation Late Start Practices. Most companies implement their pay programs on time. One-third of the companies provide a draw to offset any program late start.

- Pre-Booking Incentives. Almost half of the companies use pre-booking incentives for one or more of their customer contact jobs.

Additional Findings

COVID-19 Pay Protection

COVID-19 caused a disruption in revenues. In some cases, the change in revenue was modest. In other cases, it was significant. Among sales personnel, the impact was not uniform. Some saw only a minor impact on their territory revenue, while select peers saw a major impact. 64.2% of the companies will make changes to sellers’ compensation due to COVID-19. For companies where the negative impact on revenue was greater than 15%, 70.8% of the companies will provide some form of incentive pay protection.

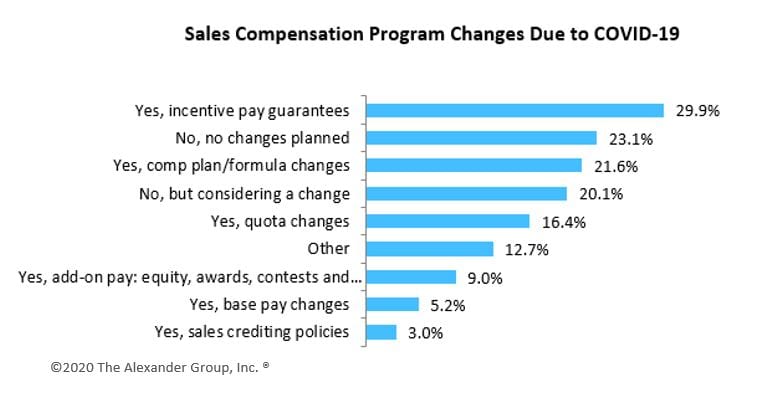

The most popular method is to provide a guarantee (29.9%), some amount greater than 50% of target incentive. Other pay protection techniques include compensation sales plan/formula changes (21.6%) and quota adjustments (16.4%). 57% of the companies used multiple methods, including one-off adjustments for specific territories.

Restart Techniques

Companies are eager to “restart” their sales efforts. With the arrival of COVID-19, most sales teams quickly pivoted to “COVID-19 selling:” virtual selling, social distancing and stay-at-home practices. 28.6% will reduce headcount. For those needing to “restart sales,” 54.1% plan to provide additional seller incentives. More than half (53.4%) plan to offer buyer incentives.

Recurring Revenue and Renewals

Across many industries, companies provide products and services supported by recurring revenue. The customer does not purchase the product, but “rents” the functionality on a monthly basis; thus, the seller/provider earns “recurring revenue.” 68.7% of the survey participants earn recurring revenue for some set of products and services.

Companies plan for renewals of recurring revenue contracts. These renewals will be incorporated into the seller’s quota. Here is the sales compensation challenge: What happens to incentive pay if the seller has the customer renew the contract prior to the performance period containing the anticipated quota? Only 14.1% make quota, credit or timing adjustments. Likewise, what if the seller closes the contract after the expiration date, causing it to fall into the next performance period? Regardless of quota implications, most companies credit at time of sale. However, 20.3% will make some type of adjustment to the credit timing or amount for late signing.

Program Implementation Late Start Practices

While not the intention, there are many reasons why sales compensation plans are late. The goal is to implement the new sales compensation plan at the start of the fiscal year. Numerous reasons, such as late quotas (13.4%) or late formula design (11.9%), cause the delay. Some companies (33.9%) provide a draw to incumbents as they await their “late” sales compensation plans to arrive.

Pre-Booking Incentives

One of the tenets of sales compensation design is to “pay for results.” That is, the incentive program pays for confirmed sales bookings or revenue received. Any measure prior to the official acceptance of an order (and invoice issued) is considered a “pre-booking” event or activity. 48.1% of the reporting companies have one or more jobs paying incentives on pre-booking milestones or activities.

Reasons for providing pre-booking activities could include one or more of the following:

- Teaching: For some jobs, sales leadership uses the incentive plan to teach the “right” sales behaviors.

- Execution Excellence: Sales management might have a tightly engineered “successful selling process” that sellers must follow. Sales leadership rewards sellers for compliance to this preferred selling model.

- Only Accountabilities Are Pre-Booking Actions: Finally, some jobs only focus on pre-billing activities such as “securing qualified leads.” In such cases, the only measurements available for incentive purposes are pre-booking milestones or activities.

David Cichelli is a revenue growth advisor for the Alexander Group. Connect with him on LinkedIn.