Addressing the Outpatient Market

As medical device manufacturers seek out opportunities for top-line growth, many sales leaders are looking to the outpatient setting (and with good reason). In the last two decades, the number of Ambulatory Surgical Centers (ASCs) and Hospital Outpatient Departments (HOPDs) has grown dramatically in the U.S., indicating a clear shift toward the outpatient setting. While this trend presents substantial opportunity, it also presents several challenges for sales leaders to address.

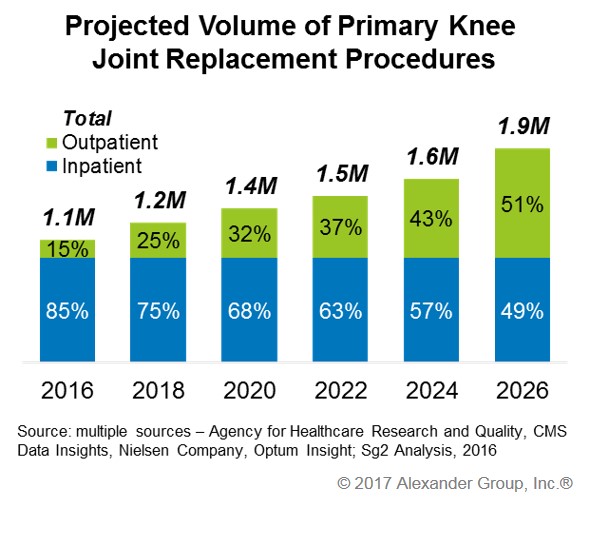

Between 2000 and 2015, the number of Medicare-certified ASCs increased by 78 percent, jumping from 3,028 to 5,446 facilities, respectively (according to CMS¹ data and MedPAC analysis in 2015). Research indicates that hospital case volume will continue to shift toward the outpatient setting, including some of their most profitable orthopedic and joint reconstructive procedures. Analysis from a 2016 Sg-2² study predicts that 52 percent of primary knee joint replacements will be outpatient by 2026, a remarkable increase from the 15 percent of these procedures that were outpatient in 2016.

Not all outpatient facilities are the same: While ASCs and HOPDs are both outpatient, it is important to recognize their differences. HOPDs are hospital-owned and provide hospitals with an avenue to more favorable outpatient reimbursement rates. In contrast, physicians with different priorities, capabilities and financial interests typically either partially or fully own ASCs.

Broader range of customers and sales motions: In the acute space, sellers already navigate a complex web of buyers and seek approvals beyond the physician. Adding potentially thousands of physical call points and customer contacts leaves sales leadership facing several tough questions:

- Do sellers have enough time and bandwidth to cover these new call points?

- Does the sales process differ between inpatient and outpatient?

- How should sellers prioritize their time between inpatient and outpatient?

Different needs and value propositions: While outpatient facilities grow in number and expand their offerings, they will never be able to replace the capabilities or match the scale found in the acute space. ASC and HOPDs have limited facility size, narrower set of capabilities/offerings and sensitivity to cost results in different needs than the acute space. In addition, sellers must be able to balance their clinical and financial value propositions as physicians now have a vested interest in ASC financials and profitability. This may require a new or broader skill set for sellers that have primarily excelled due to their clinical expertise.

Based on recent studies by the Alexander Group (AGI), organizations are exploring various approaches to address these new challenges including:

- Create separate sales teams dedicated to outpatient or ASC facilities.

- Introduce new sales motions with tele-based sales coverage and support, junior seller coverage, and less clinical support than in acute space.

- Differentiate offerings for outpatient settings including different/new products, product bundling or de-bundling, and competitive pricing.

- Consider additional incentives for penetration of outpatient market.

- Provide additional sales training and education on needs and relevant value propositions for the outpatient setting.

As your organization navigates through this shift to outpatient procedures, AGI and their Medical Device practice leaders can assist in your approach.

Contact us to get started on your outpatient market strategy.

_______________

¹CMS: Centers for Medicare & Medicaid Services

²Sg-2, LLC