Using NRR & LTV:CAC to Manage Your XaaS Business Model

Alexander Group has written extensively on XaaS metrics. The latest installment focuses on two contemporary metrics that revenue leaders should actively track and benchmark – NRR and LTV:CAC.

These metrics have been utilized by VC and PE-backed companies for multiple years, but they are now gaining traction across the broader XaaS ecosystem. Measured correctly, and supported by other productivity metrics, NRR and CAC to LTV are powerful mechanisms to evaluate marketing and sales effectiveness.

NRR stands for Net Recurring Revenue.

It measures the cumulative impact of additions and losses to recurring revenue within the customer base over a specified period of time; typically a month, quarter or year. It is a relatively simple metric that is consistently reviewed on executive dashboards because it summarizes three critical sales motions into a single number. The three sales motions include:

- Upsell: Selling more of the same product/service to an existing customer.

- Cross-sell: Selling a new product/service to an existing customer who hasn’t purchased it before. Upsell and cross-sell are often commingled and described as “expansion.”

- Churn: Renewing a previously purchased subscription. A customer may either discontinue completely or renew for a lower value relative to the previous subscription. Either path negatively impacts NRR.

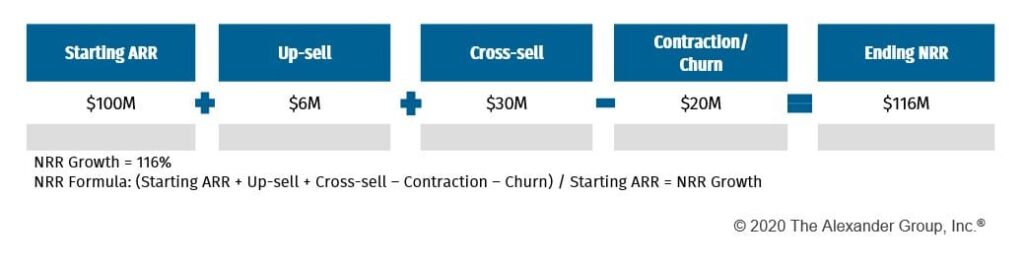

The following illustration should help:

Does 116% NRR growth indicate healthy performance? General XaaS industry practice of 107% – 112% suggests the company is performing well. Context is critical, however, as NRR performance is dependent on many factors including growth stage. Early stage, high growth companies should aim higher, while later stage companies should view 116% as acceptable.

NRR is a valuable metric for CROs and sales leaders to measure on a consistent basis. However, it does have a major drawback.

Granularity: Remember that NRR encompasses three sales motions, so it is incapable of showing specifically where growth challenges reside. Revenue leaders must break apart the number to pinpoint issues and take corrective action. The example above is a good case study:

- Cross-sell: Company A sold $30M of new products and services to its install base which represents 30% of starting NRR. Most organizations would be pleased with such marks as customer stickiness tends to increase as it purchases more products from the same vendor. It’s also typically less expensive to sell to the install base relative to prospects.

- Churn: Company A experienced $20M of contraction/churn which represents 20% of its starting NRR. Long-term growth will struggle if current performance extends into the future. Alexander Group recommends that companies strive to fall below 10% churn (90%+ retention) otherwise they will rely excessively on new logos and expansion to overcome ARR leakage.

It is particularly important to analyze each NRR element during times of uncertainty. COVID is forcing companies to reevaluate pipeline and adjust forecast as budgets tighten and purchase decisions push into the future. While growth (upsell and cross-sell) is typically a revenue leader’s priority, one can argue that churn mitigation is the most critical factor to optimize in the short-term given pending financial difficulties from thousands of businesses. Click here for practical Customer Success suggestions to manage the install base or register for our upcoming NRR Virtual Roundtable.

LTV:CAC stands for Lifetime Value over Customer Acquisition Cost.

LTV:CAC is one of the most important metrics for XaaS businesses at it represents the efficiency of a company’s business model in terms of acquiring new customers and profiting from them over time. CAC represents the total marketing and sales dollars required to acquire a customer. LTV represents the total revenue or gross profit obtained over the lifetime of the relationship. Combining the two metrics creates incremental value because it quickly tells if a business is making more money per customer than it is spending to acquire that customer.

What should companies strive for in terms of performance? LTV:CAC must exceed 1x otherwise the company loses money in perpetuity as acquisition costs exceed customer revenue in today’s dollars. Benchmarks vary in the marketplace but ideally LTV:CAC exceeds 3x for most segments or customer cohorts. Alexander Group recommends the following actions to drive up LTV:CAC:

- Enhance digital capabilities to decrease costs and/or improve productivity. Sales motion complexity varies from company to company but almost any organization can leverage digital in some way. Options vary from complex (100% self-serve sales models to capture the long tail) to more straightforward (chat specialists to qualify and progress opportunities). Schedule a digital briefing to capture Alexander Group’s most recent research.

- Double down on expansion sales. Acquiring new customers is expensive and some organizations will always rely on high-priced field sellers to close net-new business. However, that doesn’t mean organizations are handcuffed to improve the LTV numerator. Leverage Customer Success resources to identify upsell or cross-sell opportunities within the install base. Improve product telemetry to monitor usage and at-risk customers. Specialize sales coverage across the LAER spectrum.

- Solidify relationships. Now is not the time for aggressive sales pitches. Empathize with customers and provide assets/insights they can use to manage their business through the current COVID-19 turbulence. Providing a helping hand today will lead to deals in Q3 and Q4 when the pandemic subsides.

- Plug churn leaks. Retention is a critical factor in the calculation; a single percentage point change will materially impact LTV:CAC. Alexander Group suggests the following actions to improve retention: ensure renewal reps and Customer Success managers have well-defined 90-, 60-, 30-day renewal playbooks. Continuously monitor customer health scores. Lastly, adjust the underlying health score methodology to improve its retention correlation.

Technology is a fast moving industry. Business models are evolving. Metrics and KPIs will adjust as a result. Alexander Group will continue to share perspectives and benchmarks with you and other revenue leaders to ensure our community stays abreast of contemporary trends.

You may also be interested in:

Schedule a Briefing

Contact the Alexander Group and schedule a briefing to capture industry insights and frameworks on expansion growth and recommendations for increasing sales performance.