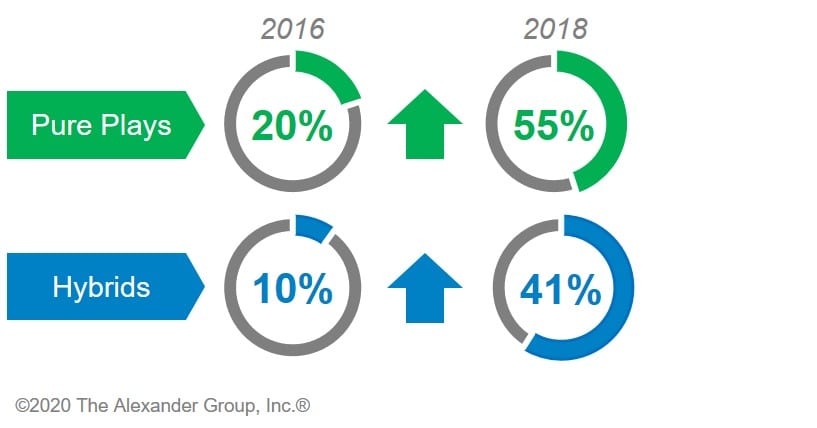

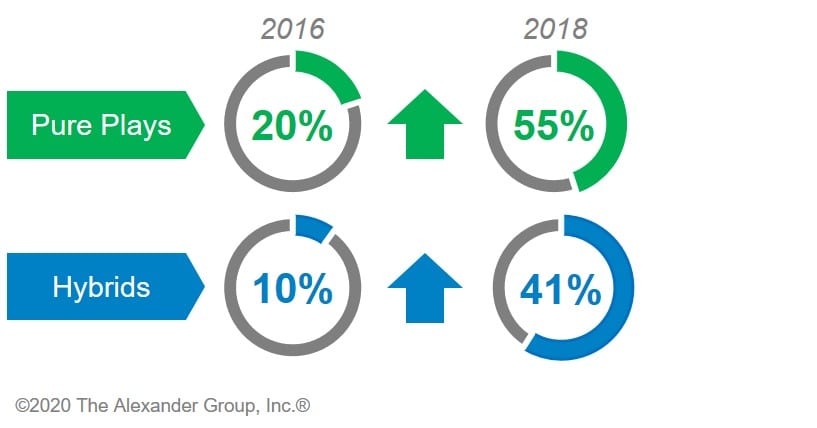

Exhibit 1: Pure Plays & Hybrids Have Increased Post-Sale Headcount Investment/Total FTE Cost

As the technology industry shifts from perpetual license or capital equipment sales to recurring license revenue, vendors face significant new investment decisions. Historically, little activity beyond maintenance renewals was required of the vendor after the initial sale. But with the transition to recurring revenue, revenue growth is now dependent on expansion and retention. As a result, leaders are reallocating their investments and modifying their existing go-to-market coverage models to focus increasingly on customers after the initial sale (i.e., via adoption, expansion, renewal activities).

Exhibit 1: Pure Plays & Hybrids Have Increased Post-Sale Headcount Investment/Total FTE Cost

Traditional IT product and service providers are transitioning to an as-a-service model (XaaS) to gain a share of recurring revenues. These companies, which we classify as Hybrids, must balance the growth of their XaaS business while supporting customers who are reliant on their legacy offerings. Alexander Group XaaS Research shows that while they are gaining share of recurring revenues and considerably increasing post-sales investments, they are still lagging their Pure Play counterparts.

Pure Plays, who are predominately reliant on XaaS, must display the ability to scale their growth and investments profitably in the face of competition and innovation from Hybrids and new entrants. Pure Plays continue to lead the market, outpacing their Hybrid counterparts in terms of market share and post-sales investments, with an average post-sales investment of approximately 55% of total headcount costs compared to 41%, as of 2018.

Alexander Group gathers detailed data on how customer-facing roles spend their customer-facing time. Using this data, we can calculate the total headcount cost of Adoption, Expansion, and Renewal activities, as a share of total sales headcount costs.

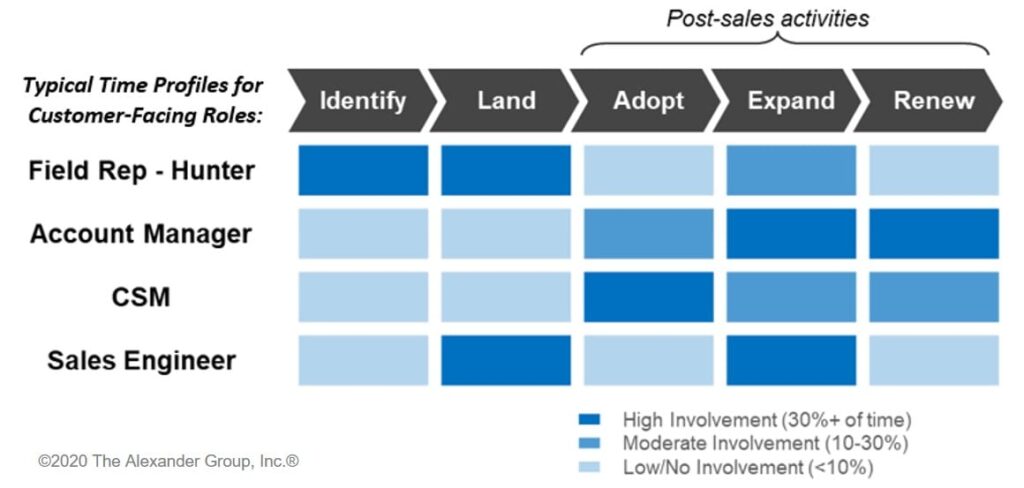

Exhibit 2: AGI XaaS Research Captures Time Profiles for Customer-Facing Roles

While both Hybrids and Pure Plays face unique challenges, they encounter similar considerations when designing coverage models to grow and retain revenues after the initial sale. Many companies establish customer success organizations and bolster farmer roles, such as renewals reps or account managers, to become more integral parts of the sales motion. Another strategy is to evolve traditional hunter roles into hunter/farmer hybrids. However, with so many hands in the pot, these approaches often lead to confusion and issues with coordination.

When evaluating how to integrate post-sales roles into your existing coverage model, consider these questions:

Are you adopting your go-to-customer coverage models and post-sale investment levels to address the evolving technology buyer journey?

Contact an Alexander Group Technology Practice leader today to learn more or participate in AGI’s on-going XaaS Research. As a participant, you will receive an executive findings briefing and customized report that includes: