Rule of 40–Coverage Models and Roles for 2020

The XaaS recurring revenue model has major implications for how companies design their go-to-market coverage and role designs (“Rule of 40–Implications for Fiscal Year Go-to-Market Planning”), which companies should review and update each year. That said, how does a company’s leadership ensure they are building the right coverage model and roles for their exact situation to ensure profitable revenue growth in 2020? Use this simple framework and key considerations to help think through your annual planning process.

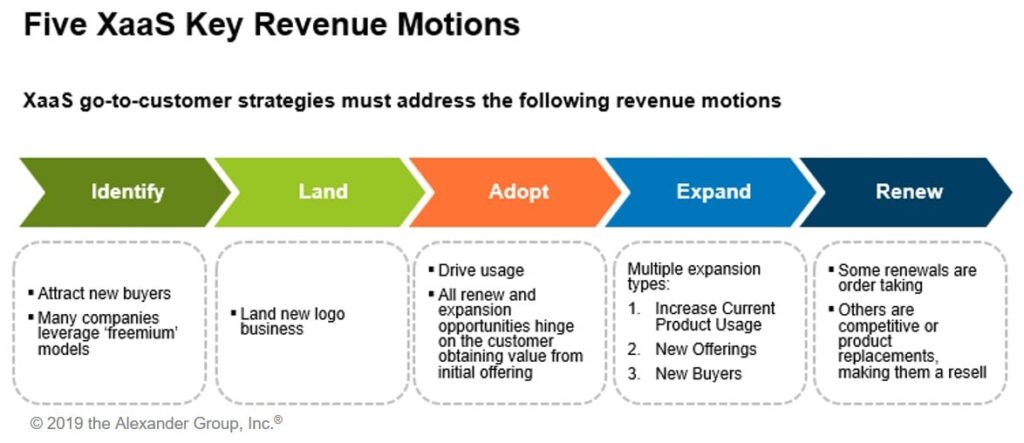

ILAER Customer Engagement Framework Overview

Customer engagement with our sales and marketing organizations is changing–particularly in a recurring revenue model. The antiquated model of accessing a customer, selling a solution and then delivering no longer works if organizations want to capitalize on customer lifetime value (CLV). Therefore, organizations must adjust. Over the last several years, a new framework has emerged in the industry that describes the entire customer engagement lifecycle. The framework, called ILAER, consists of five core revenue motions:

Overview of typical roles:

Organizations define and deploy roles in different ways depending on the company’s situation.

- Account Executive (AE): The two common deployment scenarios include 1) The AE owning the entire customer engagement model or 2) The AE is responsible for landing and expanding while other roles are managing other aspects of the customer journey.

- Account Manager (AM): The AM is responsible for managing the customer post-land, and in some instances they are responsible for the adoption, expansion and renewal activities.

- Customer Success Manager (CSM): The CSM role focuses on driving adoption in accounts.

- Renewal Rep: Renewal reps manage the renewals of subscription contracts.

Scenario 1: Subscription Revenue Acceleration

An organization looking to accelerate subscription revenue focuses on increasing their current growth rate in the Rule of 40 equation. In order to drive growth, the go-to-customer model needs a strong focus on driving new lands. A coverage model to support this strategy includes an investment in AE resources. In order to support the customer throughout their journey, a company may deploy account management resources in order to manage adoption, expansion and renewals. The goal in this model is ensure that the AE is not spending their time post-land at the expense of bringing on new logos. While this model tends to have a heavy investment in resources, the goal is that these initial lands will yield long-term recurring revenue streams.

Scenario 2: Profitability Engineering

When an organization looks to drive profitability, there is an increased focus in controlling costs. In this scenario, it is critical to refine the job roles to ensure the higher cost resources focus on high-value sales activities. Segmenting both customer and prospects into the appropriate tiers is the first step in ensuring the coverage model will both provide the customers with the right engagement model while also managing the cost to serve. While the coverage model for top of the pyramid customers will likely have an outside account executive, account manager and potentially a customer success resource, the coverage models for the bottom of the pyramid customers will differ. An inside sales and/or self-serve technology resource could efficiently serve customers in the lower tiers.

Another way to optimize the cost to serve is by introducing the role of the product specialist subject matter expert to serve as an overlay. This kind of product specialist partners with account executives to support the sales of specific products and solutions. By introducing this role, the account executive can focus on opening doors for new lands and leverage a specialist to communicate the product-specific value prop and use case. Organizations who leverage this model will have a higher productivity expectation for the account executive due to the additional sales support.

Scenario 3: Targeted Commercial Investment

Companies in this scenario are looking to exploit competitive advantage or “white spaces” in the market. This often entails implementing pro-active product specialists who, while coordinating with account execs and account managers, provide the knowledge and skills to identify and qualify opportunities for the core selling roles. These roles penetrate new markets with new or acquired offerings.

Additionally, companies often leverage the CSM during the targeted commercial investment scenario to support targeted upsells and subscription renewals. Across the tech industry, CSMs come in many flavors, but all CSMs share a core focus around customer adoption and value realization. In certain cases, however, CSMs can take on some targeted revenue responsibilities. Due to their intimacy with the customer and their deep understanding of customer use cases, they are often well-positioned to assist with upselling existing buyers, and/or act as an early warning system for potential churn.

Scenario 4: Sustainable Profitable Growth

For an organization that has been able to achieve sustainable profitable growth, the objective is to continue on this path. In this instance, organizations tend to have more roles supporting the customer engagement model. A robust segmentation process ensures that each customer segment receives the appropriate level of support. In order to achieve the full CLV, it is critical that the customer renews. Companies in this scenario will further refine roles and may often consider deploying a renewals rep. The renewals rep is solely focused on executing renewals they can offload from the AE, AM or CSM. While renewals reps typically can execute on flat renewals or transactional renewals, they might need to engage with other resources to execute on an at-risk renewal. Ensuring there are clear responsibilities and rules of engagement across the customer engagement process is crucial so that the renewals rep can independently execute on the majority of the renewals.

Regardless in which scenario an organization finds themselves, there is a coverage model to help achieve profitable revenue growth. Contact the Alexander Group to learn more about any of these scenarios or how your organization can prepare for launching your 2020 go-to-customer model.

__________________

RELATED

Why XaaS Revenue Leaders Should Care About Rule of 40

Rule of 40–Implications for Fiscal Year Go-to-Market Planning

Rule of 40-Quota Targets and Incentive Compensation

Rule of 40–Capacity & Deployment Considerations

Rule of 40 – Account Prioritization and Segmentation