Rule of 40–Implications for Fiscal Year Go-to-Market Planning

Your new fiscal year is fast approaching. As XaaS companies prepare for their annual go-to-market (GTM) planning, Rule of 40 is increasingly driving the need to think about the impact on operational decision-making. This article will provide a structure on how Rule of 40 impacts GTM planning and provide ideas on how to address specific focus areas.

Fiscal Year planning starts with a top-down understanding of the growth and profitability goals of the company. Revenue leaders will derive these goals by determining the market potential of the company’s offerings to establish growth targets, while establishing cost/margin goals based upon maximizing the valuation of the company. Enter Rule of 40, which provides guidance to company leadership on finding the right balance between growth and profitability. However, once these top-down goals have been set, the difficult task of designing an annual operating plan begins.

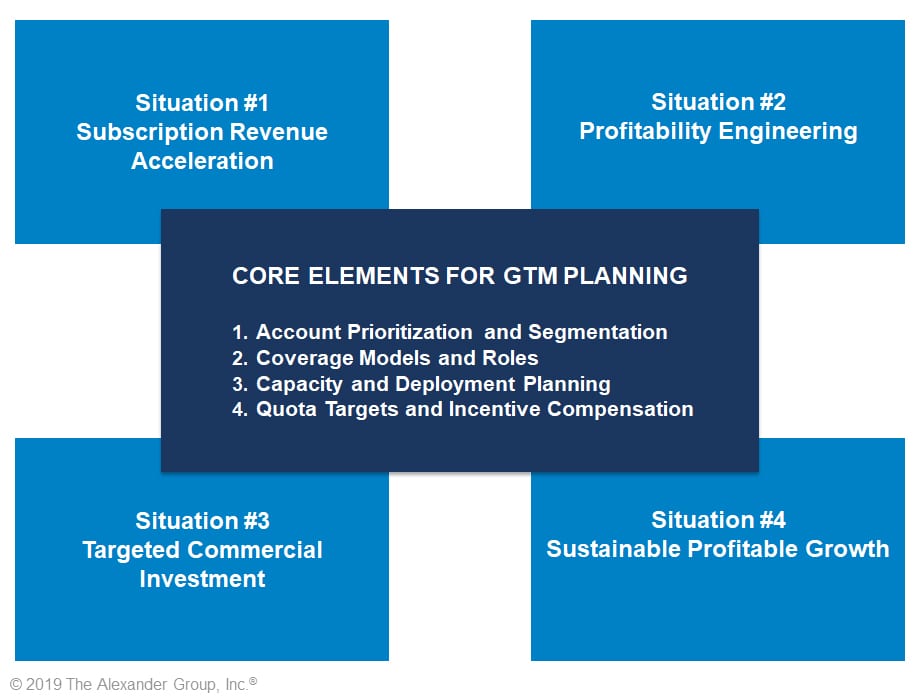

While there are many components to an annual GTM operational plan, there are four core elements that ultimately drive the revenue and cost structure for any model:

- Account Prioritization and Segmentation – What are the target segments and accounts within each on which the company will focus?

- Coverage Model and Roles – What is the appropriate set of resources (direct [pre-sales, sales, post-sales] roles, channel, digital) to cover each target segment and group of accounts?

- Capacity and Deployment Plan – How many resources are required and where/how will they be deployed?

- Quota Targets and Incentive Compensation – What is the expected productivity from each role and the appropriate compensation plan that can drive positive results?

So, how does Rule of 40 impact each of these areas? As referenced in “Why Revenue Leaders Should Care About Rule of 40,” there are four key situations that XaaS companies will fall into. These situations are: a) Subscription Revenue Acceleration b) Profitability Engineering c) Targeted Commercial Investment and d) Sustainable Profitable Growth. The situation the company is in will have an important impact on the priority and focus for each of the four core elements listed above.

Companies that are in Situation #1 (Subscription Revenue Acceleration) are typified by strong ARR growth, often with little regard to cost, particularly for high tech firms that have a significant portion of their revenue that is recurring. Planning for this phase is solely focused on growth, and as such is often dependent on the company’s ability to identify and hire core selling roles. Because scaling the organization with core selling resources is a top priority, focus on creating a highly competitive sales compensation plan that can attract and retain top talent is essential. Additionally, another area of effort and priority is enablement in order to reduce ramp time of new hires.

Companies in Situation #2 (Profitability Engineering) start rationalizing their spending on commercial resources: sales, marketing and service in light of ARR growth naturally declining from high double-digit growth. While significant opportunity across multiple accounts and segments exists, the focus shifts from growth at all costs, to growth within a strict cost window. The first place to examine is coverage models in order to identify areas where high-cost resources are performing low- or mid-cost activities. Often this involves a “lift and shift” strategy whereby core selling roles are maintained or reduced in favor of adding less expensive overlays (e.g., inside sales, product specialists, operations support) in order to boost overall productivity while simultaneously reducing cost of sales. It is also notable that within this phase, quotas of core sellers are likely to increase as the support resources should free up time to work on more or larger opportunities. More time and focus will be required for capacity planning and incentive compensation in light of having to deploy more roles.

Companies that find themselves in Situation #3 (Targeted Commercial Investment) recognize they must continue to invest to sustain growth levels, but must do so in a strategic, targeted manner to avoid stagnation. However, profitability goals will continue to weigh heavily in making the right investments. It’s in this situation where prioritization of accounts and deep customer sub-segmentation should become a key focus both encompassing new accounts and the install base. From a planning perspective, this may include significant re-alignment of accounts, and a continued deep review and update of coverage models, to ensure lift and shift, as well as provide the specialized resources needed for the targeted growth areas. Capacity and deployment models become more complex as there is a need to ensure coverage for all targeted customers and revenue streams within these customers (new logo, upsell, cross-sell and retention). Lastly, a thorough review of quota setting and incentive compensation will need to ensure that appropriate upside opportunity exists for each role. This may include special measures or incentives for targeted growth areas.

A company in Situation #4 is one where Sustainable Profitable Growth is both proven and expected. These companies recognize that the efficient production of ARR growth will free investment dollars to invest in emerging areas (new products, markets, channels). From a planning perspective, this situation requires a review of revenue and cost planning that is careful consideration similar to Situation #1. However, companies in this stage need to look carefully across the two types of ARR and define the synergies where the emerging growth ARR can leverage the existing organization without being a distraction.

Fiscal year planning is upon you, and as a revenue leader your need to maximize shareholder value by meeting and/or exceeding Rule of 40. Ultimately it boils down to having the right operational plan, which entails understanding which situation you and your company are in, and focusing on the right planning levers to ensure you hit your objectives.

The experts in AGI’s technology practice have extensive experience, frameworks, and benchmarks to ensure your operational plan will allow you to meet the profitability and revenue growth needs of your company. Contact us today to schedule a live briefing on how AGI can help you with your next fiscal year go-to-market operational plan.

________________

RELATED

Why XaaS Revenue Leaders Should Care About Rule of 40

Rule of 40–Capacity & Deployment Considerations

Rule of 40-Quota Targets and Incentive Compensation

Rule of 40–Coverage Models and Roles for 2020

Rule of 40 – Account Prioritization and Segmentation