Changing Your Sales Compensation Plan for 2021? So Is Everyone Else!

According to survey, COVID-19 impacted sales pay program for 2021.

In fact, the survey findings produced several “first-time” occurrences in the 19-year history of the survey.

Download the Executive Summary for more findings.

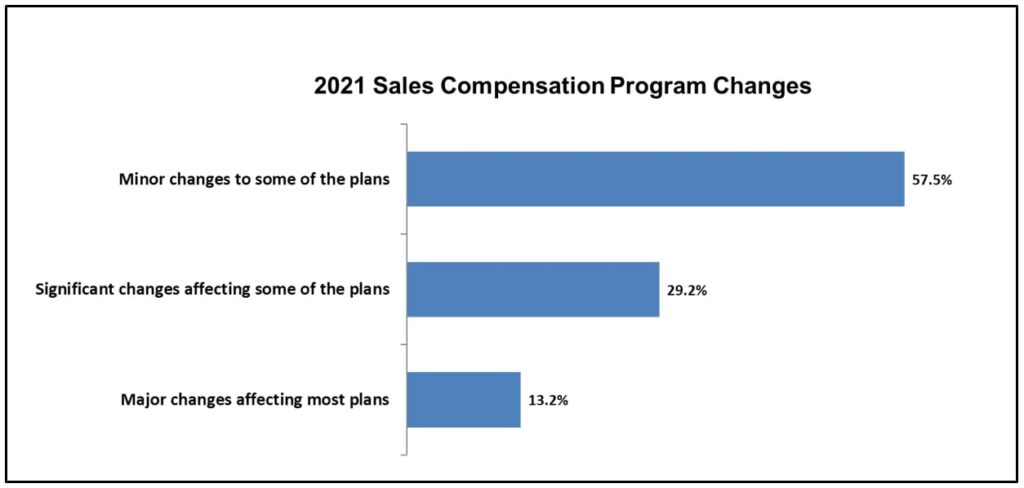

More than 100 participating companies felt the pandemic’s impact on revenue performance. Although the impact varied with some industry sectors suffering significant revenue declines and others meeting their sales forecast, a surprising few accelerated revenue performance. One of the most notable findings: For the first time in the survey’s 19-year history, 100% of the survey participants plan to make changes to their next fiscal year incentive program.

Source: Alexander Group’s 2021 Sales Compensation Trends Survey

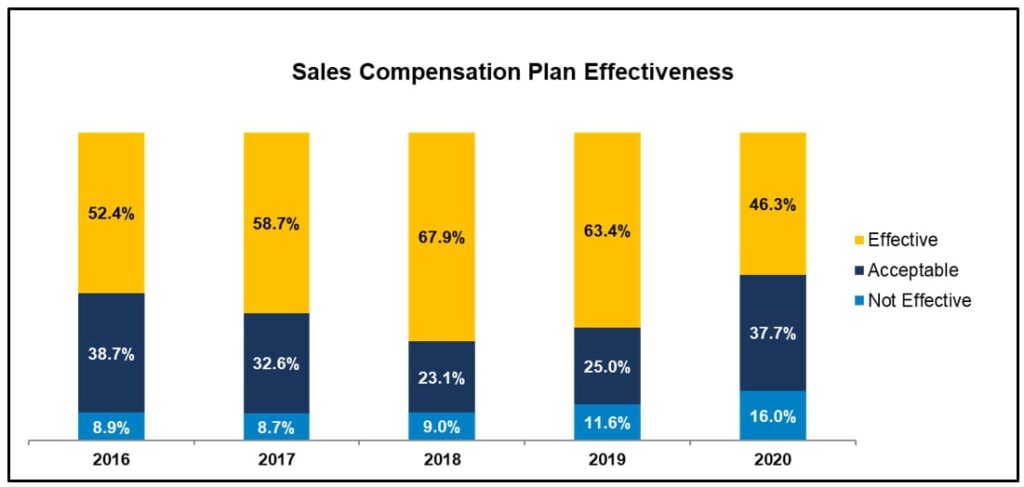

Companies were disappointed in the performance of the pay program in 2020. For the first time in five years, less than 50% of the participants reported that their sales compensation program was effective in 2020. Only 46.3% rated their sales compensation plan effective.

Source: Alexander Group’s 2021 Sales Compensation Trends Survey

Revenue Performance Skidded

Revenue leaders had anticipated a 6% revenue growth in 2020 at the end of 2019; yet, the actual median revenue growth was only 2%. Revenue performance was 90% of anticipated budget. However, companies are planning for a robust revenue increase of 8% in 2021.

What About Sales Compensation Budgets?

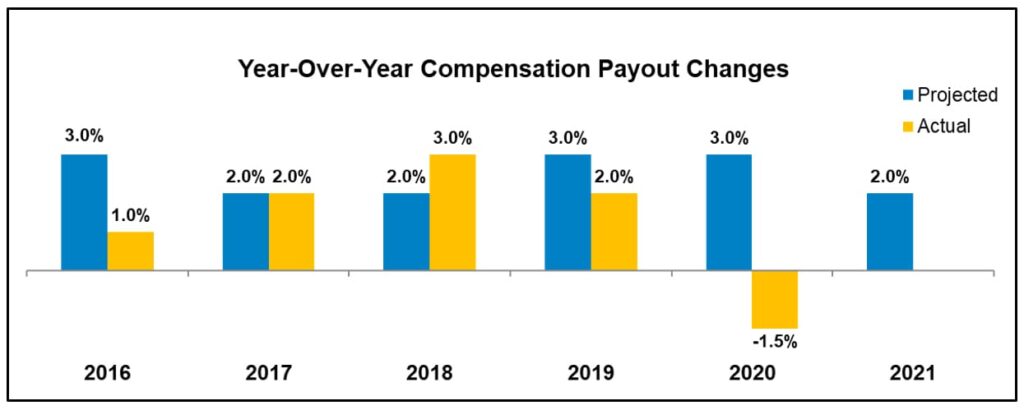

Incentive costs declined -1.5% in 2020. 2021 will see modest budget increases in base pay (3%) and total compensation costs (2%).

Source: Alexander Group’s 2021 Sales Compensation Trends Survey

What is Happening to Turnover and Headcount?

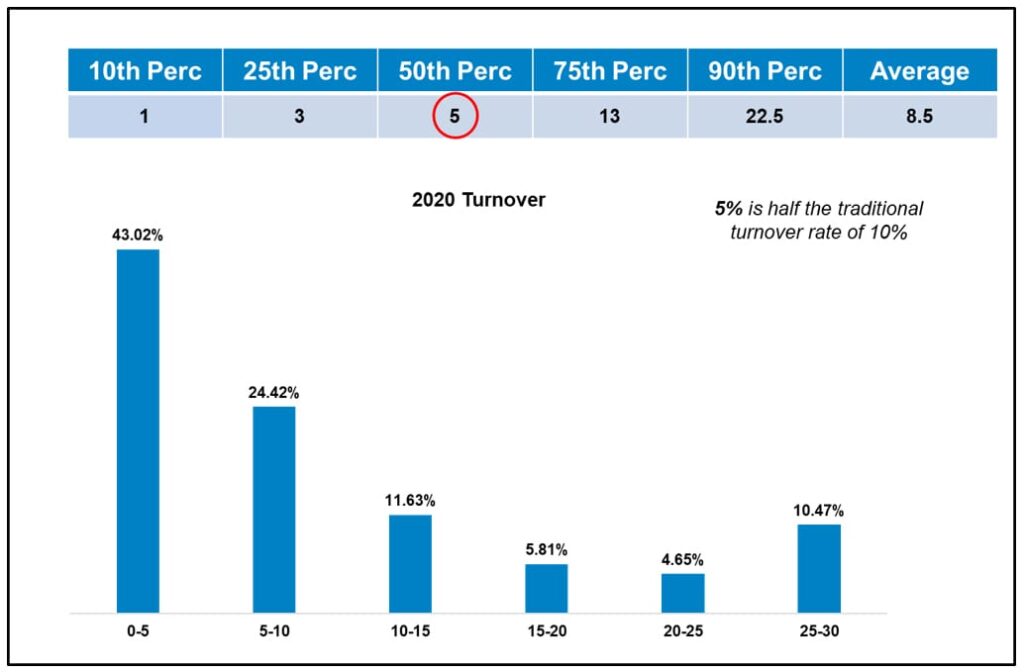

Turnover dropped in half for 2020 from the traditional 10% turnover rate for sellers to 5% in 2020. Management expects low turnover for 2021, anticipating a 5% turnover. The number of companies planning to trim headcount in 2021 more than doubled from 8.5% planned in 2020 to 17.5% for 2021.

Source: Alexander Group’s 2021 Sales Compensation Trends Survey

2021 Focus: Grow Revenue From Existing Accounts

67% said senior management is focused on growing revenue from existing customers in 2021.

Source: Alexander Group’s 2021 Sales Compensation Trends Survey

Summary

Partial incentive pay protection was common for 2021 changes. Many companies provided some degree of pay projection for those significantly impacted by COVID-19 market disruptions. Companies made adjustments on a case-by-case basis, sometimes changing quotas and formulas and, in other cases, providing sellers a minimum pay guarantee (less than target incentive) for those highly impacted by COVID-disrupted revenue performance.

Most likely, with the start of the new fiscal year, armed with new quotas and prospects for a more predictable year, sales compensation programs will once again meet revenue leadership’s performance expectations.

Want to learn more about the findings and their impact? Contact us for a complimentary briefing.

David Cichelli is a revenue growth advisor for the Alexander Group. Connect with him on LinkedIn.