Market Leader in Sales Compensation Design

Create Incentive Plans that Align Your Selling Resources with Corporate Objectives

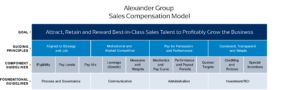

Alexander Group has helped thousands of clients, including worldwide sales organizations, realize the full benefits of effective sales compensation programs to attract, retain and reward best-in-class sales talent to grow their businesses profitably.

Recognized as the experts in sales compensation, our consultants partner with our clients to assess, align, design and implement robust sales compensation programs. Alexander Group uncovers the potential of your sales compensation program by comparing your plans against market practices and our powerful set of industry benchmarks.

The result is a compensation program that motivates sellers while maximizing your investment.

How We Help

- Achieve your organizational goals: We help organizations design best-in-class sales compensation programs that support their strategic growth objectives and align with their overall pay philosophy.

- Drive the right selling behaviors: Sales compensation is a significant lever to achieve organizational revenue growth objectives by rewarding the right selling behaviors.

- Provide market-competitive pay: Recruit and retain top talent with market-competitive compensation plans and pay levels.

- Motivate and recognize superior performance: Pay for high performance with the proper compensation structure and design programs that motivate your top performers.

- Improve your sales compensation return on investment: Motivate sales performance to drive top-line growth while controlling costs by paying for performance.

Best-in-Class Design, Best-in-Class Experience

Alexander Group is the industry leader in sales compensation design, helping organizations pave the way to profitable growth while attracting and retaining top talent. We provide experts who tailor each approach to your organizational objectives and current state. Our methods are rooted in data and align with our proven guiding principles, helping you get your organization to where you want to be.

Our proven methodology provides a structured, analytical approach to developing and managing sales compensation plans to help you adhere to your organizational goals. In addition, our expansive benchmarking network ensures your organization a long-standing, competitive edge within your industry.

With the right expertise, your company can expect to:

- Drive your organization’s goals

- Benchmark against key competitors within your industry

- Align to desired behaviors for each job

- Provide market-competitive pay

- Motivate and recognize superior performance

- Pay for persuasion and influence

- Differentiate performance levels

- Ensure consistent, transparent and straightforward plans

Our industry experts will work with you to build simple but effective compensation plans. In addition, our team will collaborate with you to determine who should be on variable plans, what pay should look like and how to set goals specific to your organization. Our incentive compensation consulting can result in business growth and a rise in sales team motivation.

Alexander Group’s proven sales compensation methodology has helped countless organizations to attract and retain top talent while profitably growing the business. To learn more about our sales compensation offerings:

- Reach out to one of our industry experts to see how we can help with sales compensation consulting and other core capabilities.

- Gather detailed insights by reading Compensating the Sales Force

- Attend a Sales Compensation presentation in your area

Need new sales compensation plans?

In a market of change, sales compensation of the past doesn’t escape unscathed. Experts at the Alexander Group look to top organizations within their industry to see how they are maintaining a motivated salesforce in today’s market.