Micro-Segmentation – the Key to Revenue Growth

One of the best ways to accelerate revenue growth is to focus sales efforts on the right customers – the ones with the greatest potential for more business. Market segmentation and customer segmentation are standard practices for seasoned revenue leaders.

Segmentation strategies are built to exploit market segments where the company has the best opportunity to win. But all too often, the segmentation exercise stops short at the level of defining segments as industries or markets such as retail, healthcare or financial. However, this approach to segmentation is usually not granular enough. To truly accelerate revenue growth, marketing and sales leaders require micro-segmentation.

What Is Micro-Segmentation?

Micro-segmentation is the process of dividing markets and customer pools into small, actionable groups with common characteristics. These data-based market and customer groups are called segments.

Micro-Segmentation Unlocks Potential

Like macro-segmentation, micro-segmentation still begins with classically defined market segments—the groups you keep together for marketing purposes. Market segment criteria can include demographics, priorities, needs, interests and other similar factors that combine to form a target audience.

But micro-segmentation goes a step further to identify viable opportunities with current customers and potential customers within those segments. This way, businesses can uncover information like the products customers prefer, their purchase history with the brand and the frequency with which they buy.

For example, knowing a company has identified sales potential in the financial services market of $10 billion is great for the executive team and interesting to the Board of Directors and shareholders when the company touts this potential in the annual report. However, the Chief Revenue Officer (CRO) is the one who is tasked with figuring out how to actually monetize this opportunity. Micro-segmentation is the answer.

The CRO can assess the current and potential customers within the financial services market, then divide those customers into groups around common behaviors. Analyzing these customer segments will pave the way for behavioral predictions and the development of marketing strategies that capitalize on those behaviors.

Getting Started With Micro-Segmentation

When should you conduct micro-segmentation, and how can you get started? In general, you cannot afford to wait. With the speed of change in nearly all markets, the advantages of micro-segmentation make it a necessity if you intend to meet and exceed your revenue growth goals.

In order to effectively utilize micro-segmentation, market insights are required, along with some form of descriptive buyer-level data. For most markets, market and consumer data are readily available. Here are some initial action steps you should take to acquire the data you need:

- Research readily available market data

- Conduct qualitative and quantitative customer buying process research

- Within the market data, identify attributes that describe your best customers

- Develop a model to find potential customers with similar attributes as your best customers

- Assign the higher probability customers to the most appropriate channels

- Re-orient your sales and enablement strategies to align with the new micro-segments:

- Value proposition design

- Revenue Motions and Channel Selection

- Sales-force job design and capacity

- Sales enablement programs-Marketing collateral — improved and more targeted messaging

If you have not conducted micro-segmentation before, consider commissioning an internal project to get started. This work is typically done by a sales strategy, planning, enablement or operations team. But not all companies have sufficient resources in these roles.

If you are resource-constrained, consider investing in a new sales strategy role to manage this effort or consider bringing in an outside firm to help you do it correctly the first time while developing the internal capabilities to manage it for you on an ongoing basis.

Developing a Micro-Segmentation Model

To properly develop a micro-segmentation model, you must answer the following questions:

- How does my product or solution satisfy a business problem?

- Who owns the wallet that will provide the funds to procure the product?

- Does my sales organization currently have relationships with the target buyers?

- Do I have enough test cases that will help identify buyer and account attributes who are more likely to buy products or services?

- Can I identify additional accounts or buyers in the market who are likely to purchase my offering?

The Micro-Segmentation Implementation Process

After conducting extensive customer research and answering key questions about your internal processes, you can begin breaking your customer pool into small groups. Micro-segmentation relies on both qualitative and quantitative attributes, but the best segmentation models utilize qualitative attributes to help inform quantitative segmentation scoring models.

Assign values to certain traits, then add the values and form groups around common characteristics. These groups should be as small and focused as possible. Specificity will enable precision in your predictive analysis, and precision leads to greater accuracy.

Capitalizing on your existing customers is only one element of micro-segmentation. The holy grail of micro-segmentation is to leverage known buyer profiles to systematically identify additional buyers in the market. Though additional buyers widen the scope of your analysis, they also open opportunities for revenue expansion.

Now that your organization has determined current and prospective buyer segments, you can begin testing marketing strategies on each one. You’ll see which groups your marketing strategies engage and which need a different approach. Repeated, real-time evaluation of your strategies against micro-segments will improve the accuracy of your predictions and, by extension, the efficacy of your marketing techniques.

Benefits of Using a Customer Micro-Segmentation Strategy

Successfully using micro-segmentation improves speed-to-market, leads to faster growth and maximizes sales investment efficiency. In highly competitive markets, micro-segmentation can also greatly enhance the probability of success. Plus, the return on the costs of doing micro-segmentation work, when done correctly, can be significant — easily 5-10-times the investment.

Ultimately, focusing marketing and sales efforts on the right customers directly impacts nearly every aspect of the sales force and results in higher win rates, shorter sales cycles, and bigger deals.

Micro-Segmentation in the Healthcare Industry

Consider the example of a large healthcare company entering a new market. The company had identified over 25,000 potential buyers in its new market. At this point, the company began developing marketing tactics and sales force design efforts to reach all 25,000 buyers in the market. This led to a trial and error approach that was very inefficient and highly dependent on front-line sales representatives calling on all the targets in their individual territories.

Trial and error is a very slow way to learn the best healthcare industry marketing tactics and salesforce designs for a new market. Essentially, the company was utilizing scarce sales and marketing investment to profile the market. As expected, the returns were subpar.

Micro-Segmentation Drove Results

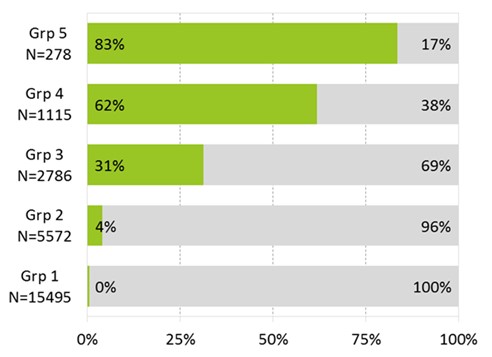

After seeing subpar results using trial and error methods, the healthcare company decided to try micro-segmentation as a means to improve their success. The company employed a scoring model, illustrated below.

To their surprise, the scoring model indicated that 21,000 of the buyers had less than a 4% probability of buying the product. Sales and Marketing redirected their efforts on buyers who exhibited greater than a 30% probability of buying the product. This gave the sales force the ability to focus on the roughly 4,000 buyers – a far easier task than calling on all 25,000! For this company, not surprisingly, micro-segmentation led to faster growth and higher revenue, while doing so at a lower level of investment.

Partner With Alexander Group for Micro-Segmentation Strategies

Alexander Group has the experience and personnel to implement a micro-segmentation strategy that drives revenue.

Want to learn more about Alexander Group’s micro-segmentation capabilities and how they can benefit your business? Please contact an Alexander Group leader to discuss your goals.