Financial institutions with engaged employees concurrently reduce bottom-line costs and enhance the customer experience to drive margin growth – reporting a +20% increase in customer satisfaction ratings for interactions with sales reps and a +23% increase for service quality.

Talent Acquisition

Impactful talent acquisition is both a part of and the result of a strong talent brand. Profitable growth leaders leverage their existing talent brand and positive employee experiences to attract top talent, who then continue to enhance the talent brand once onboarded.

To be impactful, talent acquisition should be efficient and effective. Profitable growth leaders utilize dedicated resources to spot and fill vacancies quickly and pursue candidates with unconventional, value-added skills. Organizations with established programs to advertise advancement opportunities can fill open positions up to two weeks earlier and fully operationalize sellers up to two months faster.

Building Strategic Talent Architecture

When laid out correctly, Strategic Talent Architecture bridges the gap between Talent Brand and Commercial Execution, which in turn improves both employee and customer experience. Top financial services firms are more likely to document core role elements formally and clearly:

- Jobs designed around the skills required to be successful

- Documented Rules of Engagement (ROE) between other roles

- More frequent skill assessments to drive career advancement

These leaders are less likely to lose sellers due to a lack of well-defined jobs and career paths, and they can also fully ramp up field sellers +30% faster.

Driving Commercial Excellence

Compensation & Total Rewards

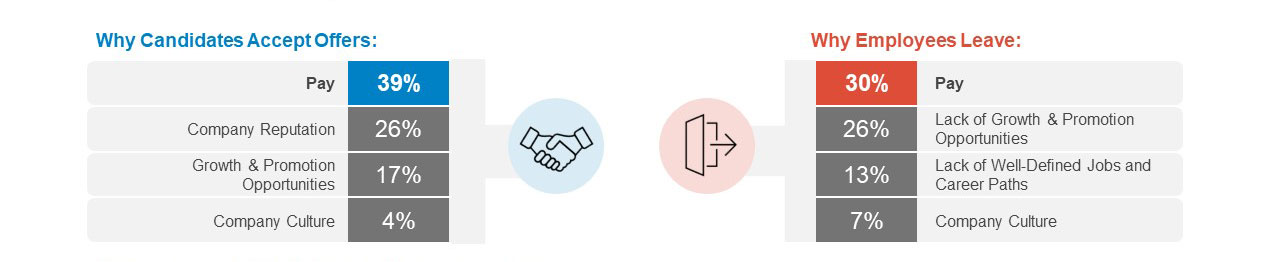

Once high performers have been identified and onboarded, organizations require successful programs to retain them. Compensation plans remain a key decision factor for employees looking to leave current positions and accept new ones.