How “General” Should a Generalist Sales Rep Be?

Whether you want the efficiencies of specialized sales roles or the versatility of generalist roles, properly defining field selling roles can have a direct impact on profitability and growth.

Industrial distributors with historically strong commercial models share certain key elements: strong local market knowledge, rapid response time for customer issues, and sales people who are all things to all customers. Sales reps who were experts on all products and applications were able to grow accounts and territories by answering any imaginable customer need.

But can versatility negatively impact productivity? Are generalist sales roles more effective than specialized roles? Alexander Group’s recent distribution project experience and research have identified three inputs that should be considered when crafting field sales roles.

Product Complexity

Industrial distributors have evolved from product pushers to providers of solutions and systems that incorporate advanced technology. This shift has expanded product and service portfolios, opened new areas of growth and increased margins. However, it has made the job of the generalist sales rep exponentially more difficult. Buyers are no longer content with sellers who have mastered the catalog and can expertly talk terms and price. They seek a technical expert that can provide value-added design services, think through alternatives to reduce long-term costs, and enable users of industrial systems. Sales reps with large territories and broad product line accountability may not have the bandwidth or the expertise to succeed in this consultative selling environment.

Time in Role

In the recent past, distribution field sellers could expect to spend an entire career working the same territory for the same company. Time was on their side–sellers learned the product offerings, territory dynamics and customer needs over the span of years and decades. Generalists’ effectiveness came from running the route and accumulating knowledge over time. However, the changing dynamics of the workforce has disrupted this model. A salesperson is less likely than ever before to spend an entire career in one role. Research from The Bureau of Labor Statistics shows that an average worker will hold 12+ jobs in a career. This trend has a significant impact on the learning curve of an industrial sales rep. Even with clean CRM data, comprehensive succession plans, and training and onboarding programs, a rep still takes months, quarters or even years to become fully productive. The broader the focus of the role, the longer the ramp up time.

Business Mix

For new distributors (or distributors new to a market), all revenue (or gross profit dollars) is equally valuable. Fast growth is the name of the game, no matter where it comes from. For larger and more established distributors, strategic growth is the goal. Profitability and sustainability depend on the right mix of products and services sold to the right mix of customers. The risk of a generalist sales model is that an individual seller may opt in or out of certain opportunities. Lack of comfort selling the product, difficulty or duration of sales cycle, and unfamiliarity with the customer’s specific needs are typical culprits. It is risky to assume that a generalist’s sales time allocation or results will align with a specific growth strategy, especially when sellers tend to take the path of least resistance to achieve sales goals.

Advantages of a Focused Sales Rep Role

The three trends above point to a movement in distribution sales role definition. Most organizations want to capture the efficiencies that come with specialization but don’t want to give up the versatility that comes with a generalist approach. The latest industry research shows that considering the following questions can inform sales role specifics.

- Hunter or Farmer? The simplest way to focus a job is to deploy them against prospects or current customers. Success in sourcing new business versus managing accounts can require vastly different skills, especially as solution complexity tends to increase the barriers to enter competitive accounts. Note that traditional account management is changing–“farmers” might still be required to convert new business units, sites or applications within an existing customer.

- Projects or MRO? The skills and tools required to sell long-cycle, spec-intensive projects differs from the transactional nature of MRO sales. It may be asking too much of a seller to be responsible for MRO sales while spending the bulk of their efforts on technically demanding solution sales. Similarly, shifting mindshare of a traditional MRO seller to project work may not succeed. Typically, roles executing a single sales motion (Fulfilment, Advocacy, or Innovation) perform better than blended roles.

- What type and how many? Managing large accounts, mid-market and small accounts requires different skills. Varied buyer needs, expectations and meeting cadences makes managing a territory with all account types difficult. Best practices in job design indicate that focusing a role on a specific segment (or two) improves productivity.

- All or some products? As portfolios expand and products become more digitally enabled, the generalist role cannot be expected to have encyclopedic knowledge of all SKUs. Well-designed jobs tend to possess either breadth of products (without a lot of depth) or mastery of a few products. When roles without much depth need to access specific product knowledge, they tap into product specialists who roll into and out of the sales process at predetermined times. Automation specialists are a commonly used role in industrial distributor models.

- Do vs. delegate? In addition to product specialists, traditional and emerging roles are helping field sellers focus on where they bring the most value to customers. Pre-sales specialists (lead generation reps), technical specialists, quoting centers of excellence and post-sales customer success roles help to free up field sellers to concentrate on the most important part of their job–persuasion. Designing a well-functioning sales role requires communication of what activities the sellers is accountable for, and what activities it can delegate to the broader team.

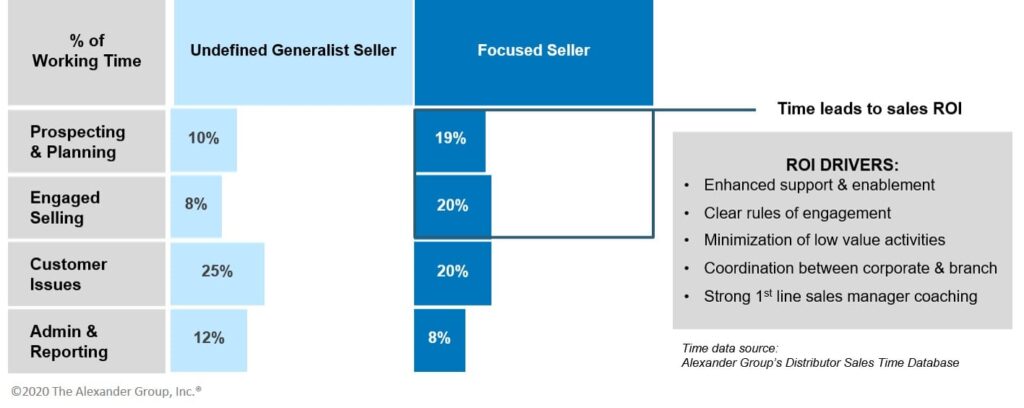

Defining field selling roles has a direct impact on profitability and growth. Our research shows that with proper role definition, sales roles spend 39% of their time in value-added activities versus 18% for unfocused generalist roles.

AGI recommends reviewing sales role execution and results annually and updating roles to coincide with changes in commercial or channel strategy. Alignment between strategic goals and role focus is critical for industrial distributors looking to grow at above-market levels. Contact us to learn more.

______________________

RELATED RESOURCES

Upcoming Manufacturing & Distribution Roundtables

March 19 & 31 2:00-3:30 PM EST

Topic: Revenue (Sales) Operations

Ensure your revenue (sales) operations function has a healthy heart and a well-functioning brain to drive sales force results and revenue growth.

May 14 & 19 2:00-3:30 PM EST

Topic: Channel Partner Programs

Unravel the vexing questions of who does what, when and how to jointly provide the solutions customers seek―and most importantly, who invest and who gets paid.

Detailed Transformation Plan to Align With New Sales Philosophy

Distributors: Differentiate Service Levels & Grow Margin