Sales Compensation Victims

Let’s start with the good news. Fortunately, most sales compensation plans work as intended.

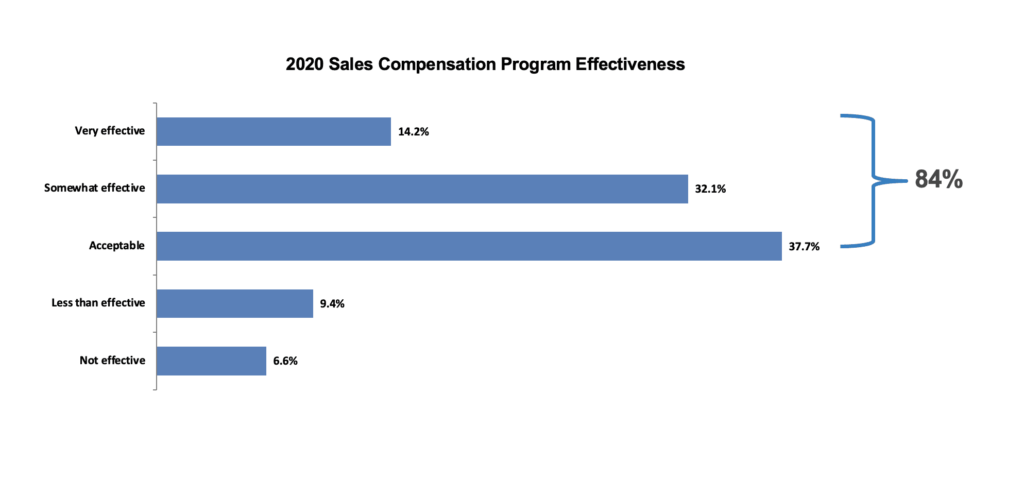

The Alexander Group’s 2021 Sales Compensation Trends Survey reveals that most companies (84%) rate the effectiveness of their sales compensation plans as acceptable or better.

Source: Alexander Group’s 2021 Sales Compensation Trends Survey

Yes, there is room for improvement. Notice only 14.2% rated their plans as “very effective” in the survey. However, for the most part, companies gave themselves good marks for their sales compensation plans.

Sales compensation is a big-dollar program. A review of the U.S. Department of Labor statistics suggests there are more than 3 million, B2B FLSA-exempt sellers in the United States. If we estimate average incentive payments at $15,000 per year, that is over $45 billion moving through sales pay programs on an annual basis. That’s a lot of money moving from companies to sellers (and that’s probably a conservative estimate). Getting sales compensation right is a big-ticket challenge.

What Do You Mean Sales Compensation Victims?

Sales compensation is for salespeople. Effective programs align sellers’ efforts with company objectives. Well-designed sales compensation plans ensure a win-win, where sellers are rewarded for successfully selling the company’s products, services and solutions. However, when not designed correctly or administered effectively, a malfunctioning pay program could negatively impact a variety of parties.

Let’s visit our potential victims.

The Sellers. “Hey, wait a minute—why are the sellers the victims? Aren’t they getting the money?” True, they are getting the money, but how suitable is their sales compensation plan? Is it easy to understand? Does it reward the right outcomes? Is it market competitive? Are payouts accurate and timely? Think of it this way: The sellers are the “customers” of a well-configured sales compensation plan. What type of “product” are you providing your sellers?

Here are practices that make sellers the victims:

- Measures: too many measures; measures they cannot influence; measures that don’t align with job accountabilities.

- Formulas: overly complicated calculations.

- Quotas: unrealistic quotas.

- Payments: late and inaccurate payments.

- Reporting: lacking timely and easy-to-understand incentive reporting.

- Documentation: incomplete communications, website scattered policies and unclear practices.

A poorly designed sales compensation plan will easily frustrate sellers.

Customers. Customers are looking for solutions. They want sellers they can trust. The best sellers listen and provide honest advice about solution applicability.

Customers become victims when the sales compensation plan drives sellers to sell the wrong products/solutions, oversell the outcomes, drive unnecessary purchase volumes, or customers are ignored because they are “too small.”

Product Management. Product management is the “other” customer of the sales force. Product management is looking for the sales force to successfully sell their products, both existing and new offerings. A particular challenge for product management is getting “mind share” of the sales force. The sales compensation plan amplifies this challenge when the sales force is selling products for numerous divisions.

Product management becomes victims of the sales compensation plan when they don’t motivate sellers to support their products. New products are a particular challenge. Product management will watch with dismay if new products become orphaned by the sales force because incentive plans do not provide suitable rewards for selling the products.

Sales Leadership. Sales leadership is constantly working to align the sales force with product division objectives and how customers seek to purchase. Sales leadership has many tools to maintain optimum alignment to achieve revenue success. The sales compensation plan is one of these tools and it can either help or hurt this effort.

Sales leadership becomes victims of the sales compensation plan when it is rigid, unchangeable and misdirects sales personnel. The sales compensation plan needs to be a moving, adaptable program; reviewed and updated annually to sustain its mission relevance.

Field Sales Managers. Field sales managers are responsible for the day-to-day management of sales personnel. The sales compensation plan helps or hurts this effort. A well-designed sales compensation plan aligns with the job’s accountabilities. Since each job has different selling objectives, each job should have its own tailored sales compensation plan. The plans should be easy to understand and have measures that sellers can influence. Policies regarding account assignments, quotas and crediting should be crystal clear.

Field sales managers become victims when the sales comp plan is confusing, poorly communicated, and not aligned with the sellers’ responsibilities. Incomplete training, lack of a “help desk” and unexplainable disparate practices also challenge field managers.

Sales Operations. Sales operations is responsible for the ongoing management of the sales compensation plans, including providing management and seller reports, assessing the plans, and answering field questions.

Sales operations becomes a sales compensation victim when the pay plan is poorly structured, has unclear policies, is (often) tweaked mid-year and is plagued with exception requests.

Commission Accounting. Commission accounting is responsible for administering the sales compensation program. Often found in sales finance, this group needs to reconcile sales crediting results, calculate incentive payments, and ensure sellers receive incentive payments in a timely manner.

Commission accounting becomes a victim when the pay plans are confusing, rely on unreliable data feeds, and require the application of complex/changing sales crediting rules.

HR/Recruiters. Your HR/recruiters are hiring the next batch of exceptional sellers. What compensation story have you given them to tell prospective applicants?

HR/recruiters are sales compensation victims when the target total earnings are not market competitive, the pay mix (ratio of base to incentive) is crushingly harsh, and the incentive plan is hard to explain to prospects.

Legal. Your legal team wants to support you. They want your pay plans to be consistent with company policies, preclude unethical practices, comply with regulatory and legal requirements, and make legal challenges by sellers unnecessary. There are numerous federal and state sales compensation requirements. Judicial and regulatory rulings are continually setting precedents. Your legal team is your best resource to help keep the sales pay plan within its legal lane.

Here are conditions that make your legal team sales compensation victims:

- Not having legal review plan design and policies.

- Making policy changes during a mid-performance period.

- Treating sellers in a disparate fashion: account assignments, sales crediting and quota adjustments.

- Contradicting a payout policy because “we never intended to pay that much money on unexpected mega orders.”

Board of Directors. Goodness, the last thing we want to do is make the board of directors a victim of the sales compensation plan! BOD members expect the revenue team to apply the sales compensation plan in an ethical and transparent fashion. They do not want a breach of company policies, ethics or legal obligations. They certainly do not want the company and its hard-earned reputation to become front-page news because of a failure of the pay program.

Summary

Most sales compensation programs work as intended on a day-to-day basis. Of course, there is often “noise,” but management should expect these program challenges. No pay program is perfect. However, no sales compensation plan should be creating victims!