Trends Driving Sales Comp Changes in Food & Beverage

The food and beverage industry is seeing consumer trends change.

Food and beverage (F&B) manufacturers are facing a multitude of commercial challenges as consumers:

- Shift preferences to more health conscious choices (e.g., non-meat/vegetarian alternatives)

- Rely on more convenient home cooking options to support new hybrid work schedules (e.g., meal delivery)

- Return to dining out on a frequent basis to re-establish social routines

All this is occurring while record high inflation puts pressure on household’s discretionary spending. This in turn, puts a spotlight on how sales compensation programs are designed, answering the age-old question of, “Are sales comp plans aligned to our go-to-market strategy and the behaviors we are looking to drive?”

Trend #1 – Sales Roles Specialization Drives Plan Design

Gone are the days when a single seller, typically aligned to a business unit, can sell a set of assigned products to distributors, retailers and restaurants. Today’s F&B sellers must have a verified understanding of their customer’s distinctive needs and be able to articulate how their products support their customer’s near and long-term business objectives. Progressive manufacturers are reorienting their sellers from business unit focused to customer segment focused. In most cases, this results in a seller carrying a larger product portfolio, but re-directing focus to one specific market or set of customers (e.g., regional retailers only).

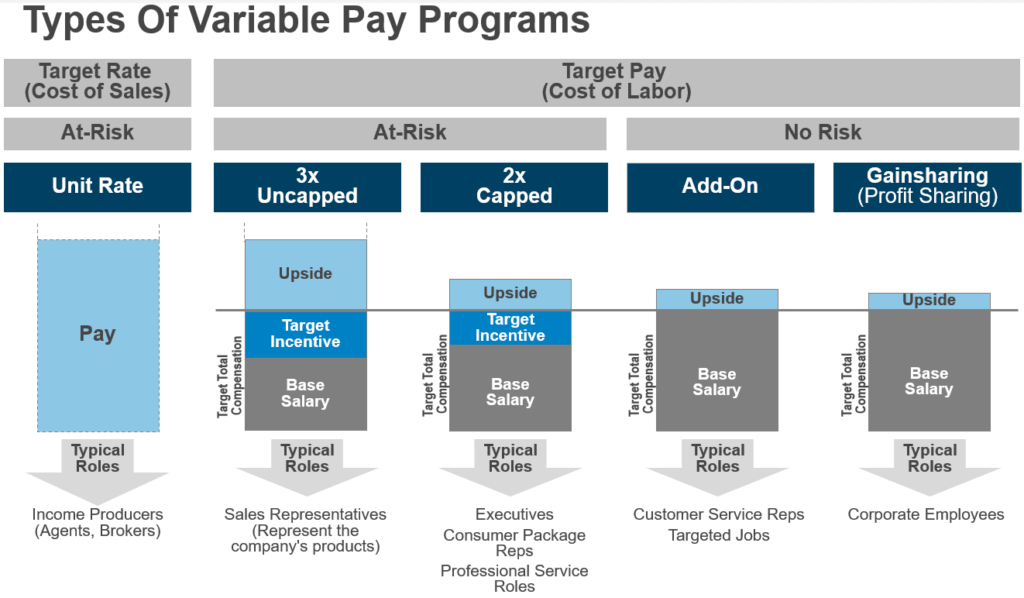

As sales roles evolve and become more specialized, F&B manufacturers need to ensure their sales compensation programs align with their go-forward commercial strategy and structure. As F&B manufacturers introduce new roles or rescope existing roles, it is imperative that they first establish a clear criteria for which roles should be eligible for sales compensation which means incorporating pay at risk programs.

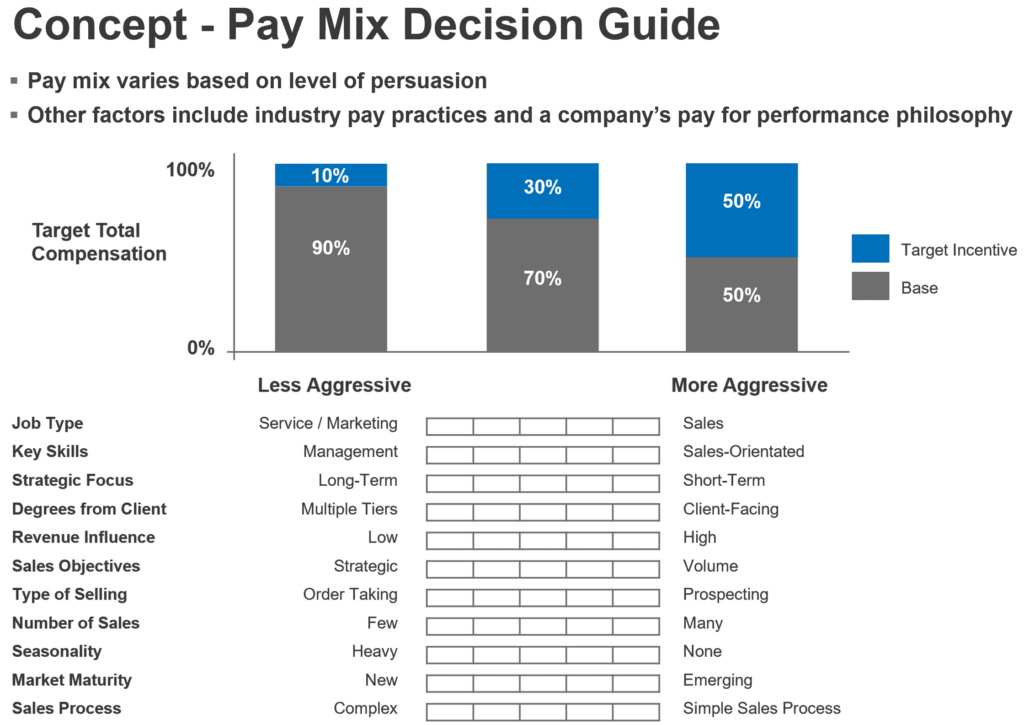

Once a designated sales compensation governance committee has confirmed the roles that should be on an at-risk sales compensation plan, a discussion regarding how much pay-at-risk each role (not individual) should have needs to happen. Typically, pay mixes are a function of the level of persuasion that each sales role has. The more persuasion, the more pay-at-risk and correspondingly, the more upside potential. It is no surprise that a channel manager working with distributors, a key account manager working directly with large national accounts and a regional seller will have varying levels of persuasion. Ensuring that you are accounting for these variations can make the difference between a plan that is celebrated for driving sales goals attainment and appropriately rewarding top performers, from one that is the source of negative comments on company review websites.

Trend #2 – Balancing Volume and Profitability in Expanded Product Portfolios

Manufacturers are responding to shifting consumer wants by launching health-conscious product lines and offering more convenient retail packaging options. Adjustments to the product assortments are necessary but can create sales execution challenges. A larger portfolio provides more choice and requires sellers to decide which products to position given their customer’s needs, the company strategy and their personal goals.

In Alexander Group’s project work, it is common to find plans with a plethora of measures. Often this is a result of trying to appease leaders across business units with means to incentivize; core offerings that drive volume, higher margin strategic brands, new product launches and so on. A team of people with 10 priorities has no priority, as everyone will self-select the one(s) they believe are right for their customers and will produce maximize reward.

Measure selection during plan design is an opportune time to have candid discussions about go-to-market. What are our strategic objectives by business unit, region, team and role? Do we want our sellers to focus on overall volume, profitability, landing new business, cross-sell or a combination thereof? How do we create alignment amongst these objectives while keeping the plans simple?

While choosing sales compensation measures by role is as much of an art as it is a science, there are a few rules to help guide this process.

Measure rules:

- No more than three primary measures (one or two measures preferred)

- Weights reflect the job’s focus and have impact >=15% of TI

- Includes no more than 1-3 secondary measures like add-on bonus, linked measures and multipliers

Each measure must meet the following criteria:

- Align to business strategy and desired behaviors for each job

- Influence their measures (line of sight) to drive accountability

- Can set attainable quotas/targets

- Can systematically track and report on measures

- Focus on objective metrics (e.g., no compliance metrics like SFDC updates)

- Is simple to understand

Trend #3 – Increased Collaboration Among Key Account, Regional Sales and Merchandising Teams

Executing more complex sales plays requires teams to collaborate more effectively and efficiently in pursuit of growth. Customers are often dealing with multiple sales representatives―spanning category buyers calling on retail headquarters, merchandisers executing in-store placement and channel partners fulfilling orders. This myriad of touch points heightens manufacturer risk as a breakdown anywhere in the value chain can disrupt business and effect customer perception.

Sales compensation is a management tool for leadership to align teams around shared goals and the distinct outcomes each team owns. Finding the balance across revenue, profitability and sales execution through the sales compensation program requires compromise and balance. One practice that F&B manufacturers are deploying is using sales compensation to drive teaming. If a teaming component is introduced, it is critical to adhere to the following:

Principles:

- Align incentives to the job’s role within a team (are we a rowing team or a football team)

- Pay for persuasion (not service or activities that do not drive revenue)

- Don’t use the plan to replace performance management practices (comp is not a replacement for sound sales management)

Plan Design:

- For commission plans, split the credit to avoid an increase in costs

- For quota plans, double credit and increase quotas accordingly

- Consider maintaining an individual component to drive personalized accountability

There are many factors to consider for F&B manufactures when designing a sales compensation program aligned to shifting consumer behaviors and evolving go-to-market strategies. The conundrum of motivating a sales culture embedded in current ways of operating to a new future is a challenging one, but not impossible. F&B leaders can solve this challenge by aligning go-to-market strategy, job role designs, pay program structures and how rep performance is measured with sellers’ pocketbooks.

For more information on how you can build a best-in-class sales compensation program, please contact a manufacturing practice leader.