Second-Half Actions for Tech Revenue Leaders - Part 2

The Alexander Group recently executed Part 2 of its second-half planning virtual roundtable series.

Over 75 revenue leaders participated, ranging from large cap technology companies to high-growth startups. The conversation centered on how to leverage quotas and sales compensation in the post-COVID-19 reopening and ramp-up. Part 1 of the roundtable series covered account targeting, resourcing and territory balancing.

Key findings from Alexander Group’s recent COVID-19 flash survey helped frame the discussion:

- Quota Adjustments: 20%1 of tech companies have provided quota relief with another 47% considering it. As revenue leaders take action, it is imperative that quota adjustments correspond with headcount alterations, align to territory changes and provide sellers with realistic performance expectations.

- Incentive Compensation: 40%1 of tech companies are considering sales compensation plan changes. In making these changes, revenue leaders must focus on retaining “A” players and top customers.

1 2020 Alexander Group May COVID-19 Flash Survey

In-session polling was used to gain an updated, additional perspective from participants and is referenced in the following sections.

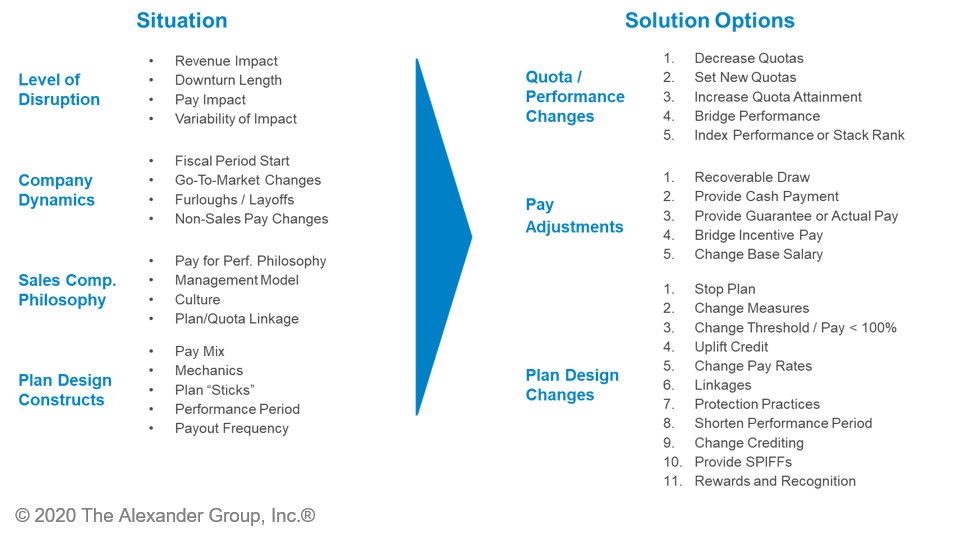

The right quota and sales compensation solution will vary based on each company’s situation including business disruption, company dynamics, sales compensation philosophy and current plan design constructs. Solutions can be categorized into three areas: quota/performance changes, pay adjustments and structural plan design changes.

Touching on each of the areas, roundtable participants shared a variety of perspectives, both short-term and more permanent, to position their organizations for growth.

10 Key Takeaways:

- Alexander Group’s perspective based on actions from previous downturns suggests the most common solutions are quota reduction or draws/guarantees. Where companies are changing plan designs, common adjustments include shifting to milestone based measures, reducing thresholds, removing complicated linkages and moving to shorter performance periods to reduce uncertainty.

- 65% of roundtable participants have not adjusted quotas to reflect a change in market conditions. For those that have adjusted quotas, 47% have implemented a decrease across the board. In some cases companies have set brand new quotas or even increased expectations where areas of opportunity exist.

- Approaches to quota adjustments have been varied and based on available information. One participant’s approach was to reduce quotas across the board albeit with a continuation of over-assignment relative to the revised plan/forecast. Most segments, geos and markets were impacted equally by COVID-19, so the uniform reduction was implemented to minimize perceptions of inequality. At companies where impact is varied, revenue leaders outlined a process of data-driven actions, where quotas were only adjusted in markets and segments with a material drop in bookings and pipeline.

- Many companies are adjusting performance to prevent disconnects with the overall business plan. Some participants increased performance to goal (e.g., if current performance was 60% to goal, increasing to 80%). One company analyzed historical usage data to apply a different uplift for each region and country. This approach worked for existing performance but there is greater uncertainty looking forward to the second-half of the year.

- The majority (80%) of roundtable participants are not making adjustments to pay or are still considering options. Of the 20% that are making changes, half have adjusted base salaries. One company provided employees the option of taking a voluntary 5% or 10% pay cut. As a global organization this helped overcome local country requirements (Works Councils) related to pay cuts. Responses were much higher than anticipated, with many employees recognizing that layoffs may lead to additional workload for employees that remain. Decisions were kept confidential and can be rescinded at any time. This approach supported culture building and was adopted in tandem with transparency around pay cuts for senior leadership.

- Pay Curves are being adjusted to mitigate potential uncertainty. Where typical performance thresholds may sit at 60%+, some participants are considering a threshold reduction or removal to allow payouts at a lower level of performance. This adjustment helps maintain seller motivation and support reasonable cash flow.

- Embrace the opportunity to focus on strategic offerings. Some companies are using this crisis as a way to double down on strategy by creating more incentive differentiation between strategic products vs. legacy products. Amplifying payouts on strategic products can serve as a mechanism to bridge earnings gaps.

- Ancillary programs have also been impacted by COVID-19. Many planned President’s Club trips have been postponed or canceled and companies are trying to determine the best path forward. One company conducted a poll with club winners to determine whether to postpone the trip or provide a cash payout. Respondents preferred cash and the company followed thorough with payments. Others have placed club programs on hold and may not resume eligibility until business is more predictable.

- SPIFFs have been introduced to mitigate the impact without permanent changes. SPIFFs have mitigated some reps’ frustrations at companies where quotas haven’t been reduced. One roundtable participant introduced a quarterly program that temporary doubled commission rates and the response has been phenomenal. “It’s not about performance/quota attainment this year. It’s about a reasonable paycheck.” Other participants, particularly those working at companies with longer performance periods, cited SPIFFs as a partial solution. “Reps still want a realistic quota regardless of temporary earnings infusions.”

- Communication around temporary programs is important to sustain motivation. Some companies are looking to introduce programs to accelerate growth through the second half of 2020. Fast start SPIFFs or commission uplift programs are being introduced to take advantage of the expected uptick and encourage early Q3 deals. Participants have been cautious about revealing these incentives prior to launch so that undesirable behaviors do not occur (e.g., deal pushing).

The impact of COVID-19 will have broader impacts on the way sales organizations go-to-market and engage customers. Companies that adapt in the near-term and work to align quota expectations and sales compensation solutions over the coming months will emerge stronger. The focus on retention of top performers, keeping sellers whole and setting teams up for success will enable them to capture opportunity during the uptick.

Additional XaaS Assets for Your Company

Learn more about upcoming events for tech leaders.

Visit our tech industry practice page for contemporary insights on revenue growth.

Participate in in our complimentary 2020 XaaS Strategy Research to capture the latest tech trends, benchmarks and insights.

Contact us today for a more in-depth discussion of the roundtable highlights and how to best position your organization for the second-half and 2021.

Chris Semain, principal in the San Francisco office, contributed to this article.